Term Life vs Whole Life Insurance Understanding Your Options

Term Life vs Whole Life Insurance is a crucial topic for anyone considering financial security for themselves and their loved ones. With various options available, understanding the fundamental differences can empower you to make informed decisions that align with your long-term goals. This guide dives deep into both types of insurance, highlighting their features, benefits, and who they are best suited for, ensuring you have the knowledge needed to navigate your choices.

Whether you’re looking for affordable coverage for a specific period or a lifelong investment that accumulates cash value, this overview will provide clarity on how each insurance type operates. By the end, you’ll be well-equipped to weigh your options and decide which policy might serve your needs best.

Overview of Term Life Insurance

Term life insurance is a type of life insurance policy that provides coverage for a specified period, or “term.” This insurance is designed to offer financial protection for beneficiaries in the event of the policyholder’s death during the term. One of its primary features is that it typically pays out a death benefit if the insured passes away within the coverage period, making it an affordable option for those seeking peace of mind without the complexities of permanent life insurance.Term life insurance policies usually come in a variety of duration options, ranging from short-term plans of 5 to 10 years to longer-term plans of 20 or even 30 years.

This flexibility allows individuals to choose a term that aligns with their financial obligations and life stages, such as raising children or paying off a mortgage. When purchasing a term life insurance policy, applicants generally undergo a straightforward process that involves assessing their health status, lifestyle choices, and coverage needs, followed by submitting an application to their chosen insurance provider.

Duration Options for Term Policies

Understanding the different duration options for term life insurance is crucial when selecting a policy that best fits one’s financial plans. Here are the common terms available:

- Short-Term Policies: Typically ranging from 5 to 10 years, these are ideal for temporary financial needs, such as covering the years until children are financially independent.

- Medium-Term Policies: Coverage that lasts for 10 to 20 years is suited for individuals with longer-term financial commitments, like mortgages or business loans.

- Long-Term Policies: Some policies extend up to 30 years, providing coverage during significant life phases, such as raising a family or planning for retirement.

Obtaining a Term Life Insurance Policy

The process of obtaining a term life insurance policy is generally straightforward and can often be completed online. This typically involves several key steps to ensure that the applicant receives the best coverage suited to their needs:

1. Determine Coverage Needs

Assessing financial responsibilities such as debts, living expenses, and future goals helps to identify the appropriate coverage amount.

2. Research Providers

Comparing different insurance companies and their offerings helps in finding competitive rates and favorable policy features.

3. Complete the Application

Applicants fill out a detailed application form, which includes personal information, health history, and lifestyle factors that may affect underwriting decisions.

4. Undergo Medical Underwriting

Depending on the policy and coverage amount, some insurers may require a medical exam or additional health assessments to evaluate risk.

5. Review Policy Terms

Once approved, the applicant receives a policy document that Artikels the terms, coverage details, and premium amounts for review before final acceptance.

Obtaining term life insurance provides a safety net for families, ensuring that loved ones are financially supported during critical periods.

Overview of Whole Life Insurance

Source: insuranceandestates.com

Whole life insurance is a type of permanent life insurance that provides coverage for the insured’s entire life, as long as premiums are paid. This insurance policy not only offers a death benefit to beneficiaries upon the insured’s passing but also accumulates cash value over time. Whole life insurance is characterized by its stable premium rates and guaranteed cash value growth, making it a reliable choice for individuals seeking long-term financial security.The cash value component of whole life policies sets them apart from term life insurance.

As the policyholder pays premiums, a portion goes towards building this cash value, which grows at a guaranteed rate determined by the insurance company. This cash value can be borrowed against, withdrawn, or used to pay premiums, providing the policyholder with flexible financial options throughout their life. It’s important to note that any loans taken against the cash value will reduce the death benefit if not repaid.

Premiums and Benefits of Whole Life Insurance

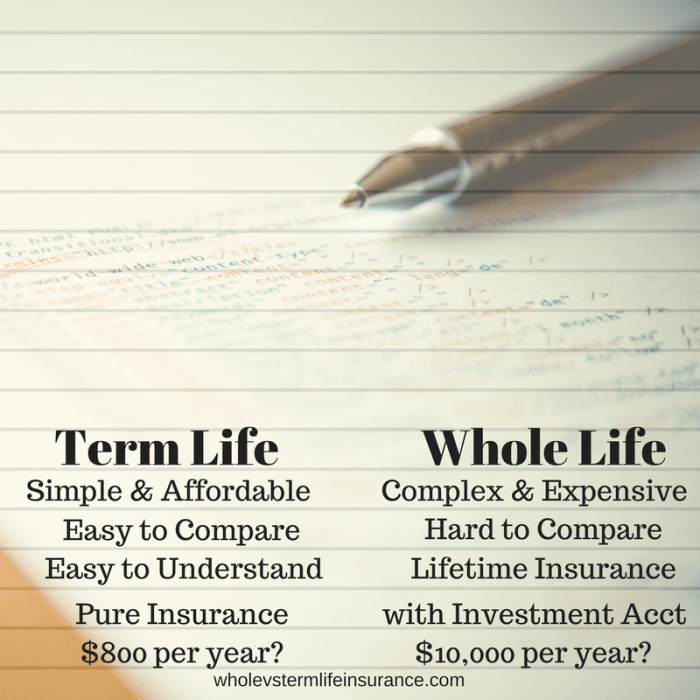

When comparing premiums and benefits of whole life insurance to term life insurance, several key differences emerge. Whole life insurance typically has higher premiums due to its permanent nature and cash value component. However, this guarantees lifelong coverage and a cash accumulation feature.The following points highlight how premiums and benefits differ between whole life and term life insurance:

- The premiums for whole life insurance are fixed and will not increase over time, providing predictability in budgeting.

- In contrast, term life insurance premiums may increase significantly upon renewal, especially as the insured ages.

- Whole life policies provide a death benefit that is guaranteed to be paid out, while term policies only pay out if the insured passes away during the specified term.

- Whole life insurance can accumulate cash value that the policyholder can access during their lifetime, enabling them to leverage their policy as a financial asset.

- Term life insurance does not provide any cash value, and once the term expires, the policyholder may lose coverage without any return on premiums paid.

In summary, while whole life insurance is generally more expensive than term life insurance, it offers lifelong coverage and the added benefit of cash value accumulation, making it an attractive option for those looking for stability and long-term financial planning.

Key Differences between Term and Whole Life Insurance

Understanding the key differences between term and whole life insurance helps individuals make informed decisions about their coverage needs. Each type has its own unique features, benefits, and costs that can significantly impact one’s financial planning. This section dives into the important aspects that set these two insurance products apart, including cost structures, benefits in various scenarios, and circumstances that may lead one to choose one over the other.

Cost Structures of Term vs Whole Life Insurance, Term Life vs Whole Life Insurance

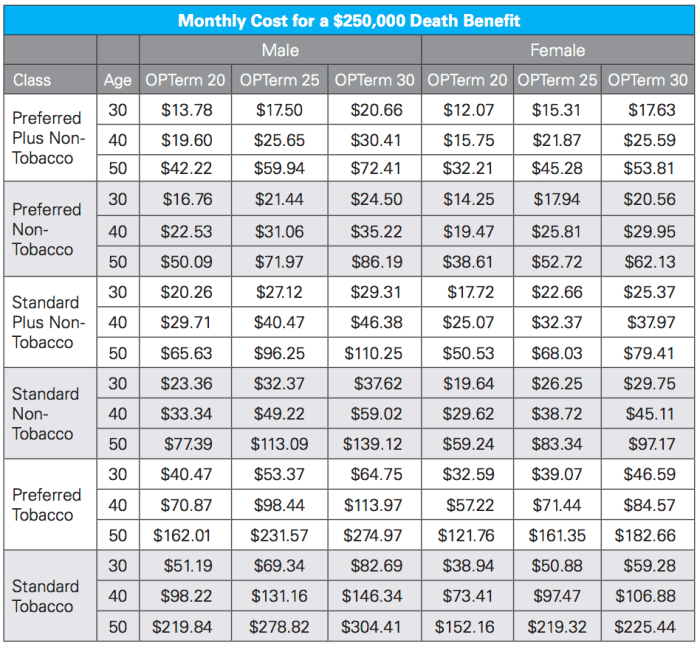

When comparing the cost of term and whole life insurance, it is essential to consider how each policy is structured and what it offers.

- Term Life Insurance Costs: Term life insurance is typically more affordable than whole life insurance. This is because it provides coverage for a specific period, usually ranging from 10 to 30 years, and does not include a cash value component. The premiums are generally lower, making it accessible for individuals seeking basic coverage without breaking the bank.

- Whole Life Insurance Costs: Whole life insurance, on the other hand, has significantly higher premiums due to its lifelong coverage and the cash value accumulation feature. A portion of the premium goes into a savings account that grows at a guaranteed rate, thus increasing the overall cost of the policy. Additionally, whole life insurance premiums remain level throughout the insured’s life, which can be a financial commitment over time.

Benefits in Specific Scenarios

Both term and whole life insurance offer distinct advantages, depending on one’s financial situation and life goals.

- Advantages of Term Life Insurance:

Term insurance is beneficial for those seeking temporary coverage, such as young families needing protection while children are dependent. It is an excellent choice for individuals with short-term financial obligations like mortgages or student loans, allowing them to secure financial peace of mind without long-term commitments. - Advantages of Whole Life Insurance:

Whole life insurance is ideal for those looking for a lifelong policy that builds cash value over time. This can serve as a financial asset that can be borrowed against or withdrawn in times of need. Additionally, whole life insurance policies can provide stability and peace of mind for estate planning, ensuring that beneficiaries receive a guaranteed death benefit regardless of when the policyholder passes away.

Circumstances for Preference

Choosing between term and whole life insurance often depends on specific life circumstances and financial goals.

- When to Choose Term Life Insurance:

Opting for term life insurance makes sense for individuals with temporary financial responsibilities, such as parents of young children or those with significant debts. It offers a cost-effective solution for those who need high coverage amounts without lifelong financial obligations. - When to Choose Whole Life Insurance:

Individuals planning for long-term financial security, such as those looking to leave a legacy for their heirs or those who want a forced savings plan, may prefer whole life insurance. It serves as a versatile financial tool, providing both coverage and cash value accumulation.

Financial Implications: Term Life Vs Whole Life Insurance

Understanding the financial implications of term life versus whole life insurance is crucial for making informed decisions about your long-term financial planning. While term life insurance offers a straightforward death benefit for a specified period, whole life insurance provides lifelong coverage and a cash value component. Each option has distinct financial ramifications that can impact not only your immediate budget but also your future savings and estate planning.

Long-term Financial Impact of Whole Life Insurance

Whole life insurance is designed as a long-term financial strategy. It involves higher premiums compared to term life but offers the advantage of cash value accumulation. Over time, a portion of your premium payments contributes to this cash value, which grows at a guaranteed rate. This growth can be leveraged for loans or withdrawals, providing financial flexibility as your needs evolve.

The cash value typically grows tax-deferred, offering an additional layer of benefits. Moreover, the death benefit is guaranteed to remain intact, ensuring your beneficiaries receive a specified payout upon your passing, regardless of market conditions.

Cash Value Accumulation in Whole Life Policies

The cash value in whole life insurance policies grows over time through a combination of premium payments and an interest rate set by the insurance company. This growth occurs on a predictable schedule, making it a reliable component of your financial plan.

- Initially, a significant portion of your premium goes toward the cost of insurance and administrative fees.

- Over the years, as the policy matures, more of your premium is allocated to the cash value.

- The cash value can be accessed through policy loans or withdrawals, but it’s essential to understand that borrowing against it reduces the death benefit and may incur interest charges.

The following table illustrates the potential costs and benefits over time for both types of insurance:

| Feature | Term Life Insurance | Whole Life Insurance |

|---|---|---|

| Premium Payments | Lower initial premiums | Higher initial premiums, fixed for life |

| Coverage Duration | Specified term (e.g., 10, 20, 30 years) | Lifetime coverage as long as premiums are paid |

| Cash Value Accumulation | No cash value | Builds cash value over time |

| Death Benefit | Payout only if the insured passes during the term | Guaranteed payout regardless of when the insured passes |

| Loan Options | No access to cash value | Loans available against cash value |

A thoughtful evaluation of these factors can guide individuals in choosing the insurance type that best aligns with their long-term financial goals and family needs.

Suitability and Target Audience

When it comes to life insurance, choosing between term life and whole life insurance ultimately depends on individual financial situations, life stages, and future goals. Each insurance type serves distinct purposes and appeals to different demographics based on their unique needs and circumstances. Understanding who benefits most from each policy can guide potential policyholders in making informed decisions.

Target Audience for Term Life Insurance

Term life insurance is typically designed for individuals seeking affordable coverage for a specific period. It is ideal for younger families or individuals with temporary financial obligations. The following demographics often find term life insurance more suitable:

- Young Families: Parents who want to ensure their children are financially protected during their upbringing, often until they reach adulthood.

- Individuals with Debts: People who have significant debts (like mortgages or student loans) need coverage that lasts until those debts are paid off.

- Budget-Conscious Consumers: Those who want substantial coverage without high premiums often choose term insurance.

- Individuals in Transition: People who expect their financial situation to improve, such as newly employed professionals who anticipate higher earnings in the future.

Demographics Preferring Whole Life Insurance

Whole life insurance appeals to those seeking lifelong coverage with a built-in cash value component. It is favored by individuals who prioritize long-term financial security and wealth accumulation. This demographic generally includes:

- Older Individuals: Those looking for stable, predictable insurance coverage that lasts a lifetime.

- Wealth Builders: People interested in life insurance as a means of financial planning and estate preservation.

- High Net-Worth Individuals: Those who want to maximize the benefits of their insurance policy with tax-deferred growth and cash value.

- Individuals with Dependent Family Members: Persons who want to ensure that their beneficiaries receive a death benefit regardless of when they pass away.

Life Situations Necessitating Policy Choice

Different life situations can dictate the suitability of either term life or whole life insurance. Understanding these scenarios can help individuals determine which policy aligns with their current and future needs.

- Raising Children: Parents may opt for term life to ensure financial support for their children until they become self-sufficient.

- Planning for Retirement: Individuals nearing retirement may prefer whole life insurance to lock in coverage and grow cash value for potential retirement income.

- Career Changes: Professionals in transitional phases, such as starting a new job or changing careers, may lean toward term life to cover debts and obligations during this uncertain time.

- Estate Planning: Individuals looking to leave a financial legacy can benefit from whole life insurance, which can cover estate taxes and provide heirs with a death benefit.

Policy Customization and Riders

When it comes to life insurance, customization plays a significant role in tailoring a policy to fit individual needs. Both term and whole life insurance policies offer various options for customization, primarily through riders. Riders are additional benefits that can be added to a standard policy to enhance coverage or provide more flexibility. Understanding these options can help policyholders make informed decisions that align with their personal and financial circumstances.Policy customization can significantly influence both premiums and coverage amounts.

By adding riders, policyholders may see an increase in their premiums, but the trade-off often includes enhanced benefits that can be invaluable in certain situations. Customization allows individuals to shape their policies based on their specific life stages, financial goals, and potential risks.

Common Riders Available for Term and Whole Life Insurance

Various riders are available, each providing unique benefits that cater to different needs. Here are some common examples:

- Accelerated Death Benefit Rider: This rider allows policyholders to access a portion of their death benefit if diagnosed with a terminal illness, providing financial support during a critical time.

- Waiver of Premium Rider: If the policyholder becomes disabled and unable to work, this rider waives premium payments while keeping the policy active, ensuring continued coverage without financial burden.

- Child Term Rider: This rider adds coverage for the policyholder’s children, typically at a lower cost, ensuring financial protection in case of an unforeseen event.

- Accidental Death Benefit Rider: This rider pays an additional benefit if the insured dies due to an accident, offering added security for families concerned about unexpected tragedies.

- Guaranteed Insurability Rider: This rider allows the policyholder to purchase additional coverage at specific intervals without needing to provide evidence of insurability, making it easier to adapt to changing life circumstances.

The addition of these riders can make the insurance policy more comprehensive and suited to the policyholder’s lifestyle. However, it’s essential to consider how these add-ons can affect the overall cost of the insurance.

Impact of Policy Customization on Premiums and Coverage

Customizing a policy with riders and add-ons can result in variations in premiums and coverage levels. Generally, while riders enhance the overall benefits of the policy, they also contribute to an increase in the total premium. It’s crucial for policyholders to weigh the benefits of riders against the additional costs.The premium increase depends on the type of rider selected and the insured’s age and health status at the time of purchase.

For instance, a young, healthy individual may see a moderate increase in premium costs when adding a child term rider, whereas a policyholder nearing retirement may face higher premiums for an accelerated death benefit rider due to increased health risks.Moreover, certain riders provide flexibility in managing one’s policy throughout different life stages. For example, adding a guaranteed insurability rider can be advantageous for those expecting significant life changes, such as marriage or parenthood, ensuring they can increase their coverage without the need for a medical exam.

Options for Enhancing Policies with Add-Ons or Riders

Policyholders have numerous opportunities to enhance their insurance policies through various add-ons and riders. These enhancements not only provide additional security but also create a tailored insurance experience. Here are a few options that can be considered:

- Critical Illness Rider: This addition provides a lump-sum payment if diagnosed with a specified critical illness, assisting with treatment costs or other financial needs.

- Long-Term Care Rider: This rider helps cover long-term care expenses, which can be a significant financial burden as individuals age.

- Return of Premium Rider: This rider ensures that if the policyholder outlives the term of their policy, they receive a refund of the premiums paid, adding an element of savings to the policy.

In conclusion, understanding the available riders and customization options allows individuals to create a life insurance policy that not only meets their current needs but also adapts to future life changes. The right mix of riders can significantly enhance the value of a policy, ensuring comprehensive coverage and peace of mind.

Myths and Misconceptions

Source: wholevstermlifeinsurance.com

The world of life insurance is often clouded by myths and misconceptions that can significantly influence consumer decisions. Understanding these fallacies is crucial for making informed choices about term and whole life insurance. This section aims to debunk common myths and clarify misunderstandings surrounding these two types of policies, ensuring consumers have a clear picture of what each option entails.

Common Myths about Term Life Insurance

Many individuals mistakenly believe that term life insurance lacks value and is a waste of money. The reality is quite different; term life insurance provides essential coverage during the most critical years, such as raising children or paying off a mortgage. Key points to consider include:

- Temporary Coverage Misconception: Some think that because term life is temporary, it offers no long-term value. However, it serves as a safety net during specific life stages.

- No Cash Value: While it’s true that term life policies don’t accumulate cash value, this allows for lower premiums compared to whole life insurance, making it more accessible for many families.

- All or Nothing: There’s a belief that if you don’t claim the benefit, you’ve lost your investment. In reality, the peace of mind and financial security provided during the term is invaluable.

Misconceptions about Whole Life Insurance Benefits

Whole life insurance is often viewed as an investment rather than just a policy for death benefits. This misconception can lead to confusion regarding its primary purpose and potential drawbacks.Important aspects to address include:

- Guaranteed Returns: While whole life insurance provides guaranteed returns, these are generally lower than potential gains from other investments, such as stocks or mutual funds.

- Complexity: Many perceive whole life as straightforward, but it can be complex due to its features like dividends and cash value, which may confuse consumers.

- High Premiums: The cost of whole life insurance is often thought to be justified by its cash value accumulation. However, these higher premiums can strain budgets, especially for young families.

Impact of Myths on Consumer Choice

The myths surrounding term and whole life insurance can significantly affect consumer choices, often leading to decisions that may not align with their actual needs. Understanding the realities can empower consumers to select the most suitable insurance product.Consider the following implications:

- Financial Planning: Misunderstanding the purpose and benefits of each policy can lead to inadequate financial planning, leaving families unprotected in critical times.

- Policy Selection: Consumers may shy away from term insurance due to its perceived lack of value, missing out on affordable coverage options.

- Investment Misallocation: Believing that whole life is the best investment can result in overpaying for coverage and missing opportunities for potentially better returns elsewhere.

Understanding the differences between term and whole life insurance is essential for making sound financial decisions that align with one’s long-term goals.

Real-Life Scenarios and Case Studies

Choosing between term life and whole life insurance can be a significant decision that varies greatly depending on individual circumstances. Understanding when to opt for one over the other can be better grasped through real-life scenarios and illustrative case studies. These examples can provide insight into the distinct advantages and disadvantages of both types of policies, guiding prospective buyers towards the most suitable choice for their unique situations.When evaluating insurance options, it’s crucial to consider the financial implications, long-term goals, and personal situations that may influence the choice between term and whole life insurance.

Below are hypothetical scenarios that exemplify specific circumstances for each type of insurance, along with case studies that further illustrate the pros and cons associated with these policies.

Hypothetical Scenarios

The following scenarios showcase ideal situations for selecting term life insurance versus whole life insurance:

- Scenario 1: Young Family with Limited Budget

A couple in their early 30s, Jane and Mark, have two young children. They are both working but are still paying off student loans and a mortgage. With a limited budget, they opt for a 20-year term life insurance policy for $500,000. This coverage ensures their children’s financial security in case of an unforeseen event while allowing them to allocate more funds towards savings and investments. - Scenario 2: High-Net-Worth Individual Planning for Legacy

Tom, a successful entrepreneur in his 50s, is considering a whole life insurance policy. He wants to ensure that his family is taken care of after his passing and to leave a financial legacy. By choosing a whole life policy, Tom benefits from lifelong coverage, cash value accumulation, and potential tax advantages, providing a financial cushion for his heirs.

Case Studies

The following table compares real-life case studies that highlight the advantages and disadvantages of both term and whole life insurance:

| Case Study | Description | Advantages | Disadvantages |

|---|---|---|---|

| Case Study 1: Sarah’s Term Life Choice | Sarah, age 35, purchased a 15-year term life insurance policy for $400,000 to cover her mortgage and provide for her children. |

|

|

| Case Study 2: Mike’s Whole Life Decision | Mike, age 45, chooses a whole life insurance policy with a $250,000 death benefit, anticipating future wealth transfer to his children. |

|

|

“Understanding the specific needs and financial situations of individuals is key to choosing the right insurance policy for long-term security.”

Expert Opinions and Trends

Financial advisors play a crucial role in guiding individuals through the complexities of life insurance choices. Their insights often highlight the nuanced differences between term and whole life insurance, enabling clients to make informed decisions tailored to their financial situations and goals. Understanding the opinions of these experts can illuminate current trends and shifts in the insurance industry, providing valuable context for prospective policyholders.Financial advisors emphasize that both term and whole life insurance have unique advantages and should be chosen based on individual circumstances.

Term life insurance is often recommended for those seeking affordable coverage for a specific period, such as parents wanting to protect their children during their formative years. In contrast, whole life insurance is considered an investment vehicle, offering lifelong coverage and cash value accumulation.

Current Trends in Insurance Policies

The landscape of life insurance is evolving, with several notable trends emerging in recent years. These trends reflect changing consumer preferences and advancements in technology. One significant trend is the increasing demand for flexible policy options that allow for customization. Consumers are looking for policies that can adapt to their changing needs over time, pushing insurers to offer more riders and personalized coverage plans.

Another trend is the growing popularity of online insurance platforms, which enable consumers to compare policies and obtain quotes quickly. This shift towards digitalization has made it easier for individuals to obtain information and make decisions without the need for face-to-face meetings. As a result, many traditional insurance companies are now investing in technology to enhance their customer experience.Additionally, the insurance industry is witnessing a heightened emphasis on financial literacy.

More consumers are seeking to understand the implications of their insurance choices, leading to a demand for educational resources. This trend is echoed by financial advisors who advocate for ongoing education about the different types of life insurance and their respective benefits.

“Understanding both term and whole life insurance is essential for anyone looking to secure their financial future.”

Jane Doe, Certified Financial Planner

These insights and trends underscore the importance of being well-informed about life insurance options. As the market continues to evolve, both consumers and advisors must stay updated on policies and services that can best meet their financial needs.

Tools and Resources for Consumers

Source: lifeinsuranceblog.net

In the world of life insurance, having the right tools and resources at your disposal can significantly streamline the decision-making process. Understanding the differences between term and whole life insurance is crucial, and the right calculators and guides can help clarify your needs and options. This section provides valuable online resources and tips for consumers looking to navigate their insurance choices effectively.

Online Calculators for Estimating Life Insurance Needs

Estimating your life insurance needs can be overwhelming, but various online calculators simplify this process. These tools consider factors such as income, debts, and future financial goals to provide a personalized estimate. Below is a list of reliable calculators that can assist in determining the appropriate coverage for your situation:

- Bankrate Life Insurance Calculator: This calculator helps estimate the amount of coverage needed based on income and financial obligations.

- Policygenius Life Insurance Calculator: A user-friendly tool that allows you to input various financial factors to estimate your coverage needs.

- Haven Life Insurance Calculator: Provides a quick estimate of how much life insurance you might need by considering your family’s financial future.

- Life Happens Calculator: Offers personalized estimates based on lifestyle and financial responsibilities, ensuring you consider all aspects of your life.

Guide for Evaluating Insurance Options Effectively

Choosing the right life insurance policy requires careful evaluation of your unique needs and financial situation. A well-structured guide can help consumers navigate this process. Here are key steps to consider when evaluating insurance options:

- Assess Your Needs: Consider your current financial obligations, including debts, mortgage, and future expenses such as education for children.

- Understand Policy Types: Familiarize yourself with the differences between term and whole life insurance to determine which fits your needs best.

- Compare Quotes: Use multiple sources to gather quotes from various insurance providers, allowing you to compare coverage options and costs effectively.

- Read Reviews: Look for customer reviews and ratings of insurance companies to gauge their reliability and customer service.

- Consult with Experts: Seek advice from financial planners or insurance agents who can provide insights tailored to your specific situation.

Approaching Insurance Agents for Advice

Insurance agents can provide valuable insights when considering life insurance options. However, knowing how to approach them can enhance your experience. Here are tips to keep in mind:

- Do Your Research: Before meeting with an agent, familiarize yourself with basic insurance concepts and terminology to facilitate informed discussions.

- Prepare Your Questions: Compile a list of questions focusing on your specific needs, such as coverage amounts, policy terms, and potential riders.

- Be Honest About Your Finances: Share your financial situation openly to help the agent suggest the most suitable policies for your needs.

- Request Comparisons: Ask agents to provide comparisons between term and whole life insurance options to understand the best fit for your financial goals.

- Inquire About Customization: Discuss customization options and riders that can enhance your policy to better address your unique circumstances.

Closing Notes

In conclusion, understanding the distinctions between Term Life vs Whole Life Insurance can significantly impact your financial planning and peace of mind. Each type of policy offers unique benefits that cater to different life stages and financial goals. By evaluating your circumstances and priorities, you can choose a solution that not only protects your loved ones but also aligns with your overall financial strategy.

Remember, making informed choices today can lead to a secure tomorrow.

Frequently Asked Questions

What is the main difference between term and whole life insurance?

The main difference lies in the duration of coverage; term life insurance provides protection for a specific period, while whole life insurance offers coverage for the insured’s entire lifetime and includes a cash value component.

Can I convert my term life insurance policy to whole life?

Yes, many term life policies offer a conversion option, allowing policyholders to switch to a whole life policy, typically without undergoing additional medical underwriting.

Is whole life insurance a good investment?

Whole life insurance can be a good investment for individuals seeking lifelong coverage combined with a savings component, but it generally has higher premiums compared to term life insurance.

How do premiums differ between term and whole life insurance?

Term life insurance tends to have lower premiums because it provides coverage for a limited time, while whole life insurance has higher premiums due to its lifelong coverage and cash value accumulation.

What happens to the cash value in whole life insurance if I cancel the policy?

If you cancel a whole life policy, you may receive the cash value minus any surrender charges, but you will lose the death benefit coverage.