Compare Car Insurance Quotes to Save Money Effectively

Compare Car Insurance Quotes sets the stage for this essential discussion on securing the best deal on your vehicle insurance. Navigating the world of car insurance can be overwhelming, but by understanding the different types of coverage, the significance of comparing quotes, and the factors influencing premiums, you can make informed decisions. This guide will walk you through the vital components of car insurance and the best practices for selecting the right policy that suits your needs and budget.

By exploring the benefits of comparing multiple quotes, you’ll discover how this simple step can lead to significant savings on your premiums and provide you with peace of mind. We’ll also delve into common mistakes to avoid and offer tips for enhancing your chances of obtaining the best rates available.

Understanding Car Insurance

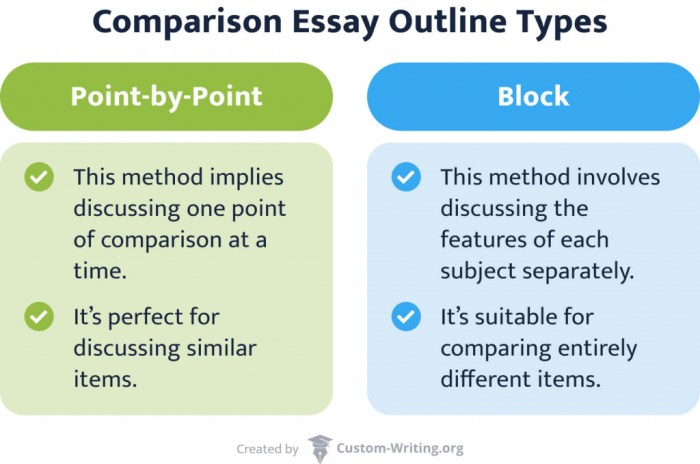

Source: custom-writing.org

Car insurance is a crucial aspect of vehicle ownership, designed to protect drivers financially in the event of accidents, theft, or damage. Understanding its components, types of coverage, and common terminology can help you make informed decisions when selecting a policy. Proper knowledge of car insurance not only ensures compliance with legal requirements but also provides peace of mind while on the road.The essential components of car insurance typically include liability coverage, collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage.

Each of these components serves a distinct purpose and offers varying levels of protection.

Essential Components of Car Insurance

The main components of a car insurance policy can be grouped into several key areas:

- Liability Coverage: This is mandatory in most states and covers damages to others if you are at fault in an accident. It typically includes bodily injury and property damage liability.

- Collision Coverage: This type of coverage helps pay for the repair costs of your vehicle after a collision, regardless of fault.

- Comprehensive Coverage: This covers damages to your car from incidents other than collisions, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with a driver who has insufficient or no insurance.

Types of Coverage Available

When considering car insurance, it’s important to understand the various types of coverage available that can be customized to suit individual needs. Each type of coverage addresses different risks and financial responsibilities.

- Personal Injury Protection (PIP): Covers medical expenses for you and your passengers, regardless of fault.

- Medical Payments Coverage: Similar to PIP, but usually has a narrower scope and may not cover non-medical expenses.

- Gap Insurance: Recommended for those with financed vehicles, it covers the difference between what you owe on your car and its current market value if it’s totaled.

- Rental Reimbursement Coverage: This pays for a rental car while your vehicle is being repaired after a covered loss.

Common Terms Used in Car Insurance Policies

Familiarity with insurance terminology can simplify the process of comparing policies and understanding your coverage. Here are some common terms you might encounter:

- Deductible: The amount you must pay out of pocket before your insurance kicks in for a claim.

- Premium: The amount you pay for your insurance coverage, usually on a monthly or annual basis.

- Coverage Limit: The maximum amount your insurance will pay for a covered claim.

- Exclusions: Specific situations or conditions not covered by the policy.

“Understanding the nuances of car insurance can save you money and ensure you have the right protection for your vehicle.”

Importance of Comparing Car Insurance Quotes

Comparing car insurance quotes is a crucial step in securing the best coverage at the most affordable rates. Many drivers overlook this important process, often settling for the first quote they receive. However, taking the time to compare multiple options can lead to significant savings and better policy features tailored to individual needs.By reviewing various quotes, policyholders can identify discrepancies in coverage and premiums, allowing them to make informed decisions.

The practice not only helps in finding lower rates but also ensures that drivers are not overpaying for coverage they might not need. A well-rounded approach to comparing quotes can reveal options that offer increased benefits and potentially lower deductibles, enhancing overall financial security.

Benefits of Comparing Multiple Quotes

Understanding the advantages of comparing car insurance quotes can lead to substantial financial benefits and improved policy choices. Here are some key points to consider:

- Cost Efficiency: Different insurers have varying pricing models. By obtaining several quotes, drivers can pinpoint the most cost-effective policy that meets their needs.

- Customized Coverage: Comparing quotes allows individuals to see a range of coverage options. This can highlight policies that offer additional benefits, such as roadside assistance or rental car coverage, at similar price points.

- Identifying Discounts: Many insurance companies offer unique discounts that may not be advertised widely. By comparing quotes, policyholders can discover deals that further lower their premiums.

- Policy Features: Some insurers may provide better customer service, flexible payment plans, or superior claims handling. Evaluating multiple quotes can help identify these valuable features.

- Market Awareness: Regularly comparing quotes keeps drivers informed about market trends and pricing shifts, making it easier to make adjustments as needed.

“Taking just a few minutes to compare quotes can result in savings that add up significantly over time.”

Real-life examples illustrate the importance of this practice. For instance, a driver named Sarah had been with the same insurer for years. After deciding to compare quotes for a new policy, she discovered that a different provider could save her $500 annually while offering better coverage options. Similarly, a recent college graduate, Mike, found that by switching insurers after comparing quotes, he qualified for a young driver discount that reduced his premium by 30%.

These examples reinforce the idea that comparing car insurance quotes can lead to smarter financial choices and greater savings.

How to Compare Car Insurance Quotes

Comparing car insurance quotes is a crucial step in finding the best coverage at a competitive price. With numerous insurers available, navigating through the options can be overwhelming. However, a systematic approach can simplify the process and enable you to make informed decisions.Gathering quotes from various insurers can be accomplished in a few straightforward steps. Keep in mind that the information you provide plays a significant role in determining your rates, so accuracy is essential.

Step-by-Step Guide for Gathering Quotes

To effectively gather car insurance quotes, follow this step-by-step guide:

- Prepare Your Information: Before reaching out to insurers, gather essential details such as your vehicle’s make, model, year, and VIN. Additionally, have your personal information ready, including your driver’s license number, address, and driving history.

- Identify Your Coverage Needs: Determine the type of coverage you require. Consider whether you need liability, comprehensive, or collision coverage based on your circumstances.

- Research Insurers: Compile a list of car insurance providers. Look for reputable companies with positive reviews and strong financial ratings.

- Request Quotes: Contact the insurers or visit their websites to request quotes. Many companies offer online quote forms that you can fill out for quick estimates.

- Compare Quotes: Once you receive your quotes, compile them in a spreadsheet or table for easy comparison. Focus on key details such as premiums, deductibles, and coverage limits.

Checklist of Factors to Consider When Comparing Quotes

When comparing car insurance quotes, it’s vital to consider several factors that can impact your choice. Here’s a checklist to guide you in the comparison process:

“A well-informed choice is better than a rushed decision.”

- Premium Costs: Compare the monthly or annual premiums each insurer offers.

- Coverage Limits: Ensure that each policy’s coverage limits meet your needs, including liability limits.

- Deductibles: Assess the deductibles for each quote, as higher deductibles usually mean lower premiums.

- Discounts: Inquire about available discounts, such as for bundling policies, having a clean driving record, or completing a defensive driving course.

- Customer Service Ratings: Research customer reviews and ratings to understand the insurer’s reputation for service and claims handling.

Using Online Comparison Tools Effectively

Online comparison tools can greatly facilitate the process of comparing car insurance quotes. Here’s how to make the most out of these resources:

“Efficiency in comparison saves time and money.”

Begin by selecting a reliable comparison website. These platforms allow you to input your information once and receive multiple quotes from various insurers. Here’s how to navigate this process:

- Input Accurate Information: Ensure that all information you provide is accurate and complete, as this directly affects the quotes you’ll receive.

- Customize Your Options: Some comparison tools allow you to specify coverage types and limits, ensuring the quotes are tailored to your needs.

- Review Quotes Side-by-Side: Take advantage of the comparison feature that shows quotes side-by-side, allowing you to evaluate premiums and features at a glance.

- Check for Additional Features: Look for tools that offer insights on customer satisfaction, claims processes, and financial stability ratings of the insurers.

Utilizing these steps and factors can lead you to find the best car insurance policy that fits your needs and budget.

Factors Influencing Car Insurance Premiums

Understanding the various elements that influence car insurance premiums can empower you to make informed decisions when purchasing coverage. By recognizing how these factors interact, you can potentially lower your insurance costs and choose a policy that best suits your needs.One of the primary factors that determine your car insurance premium is your driving history. Insurers closely examine your past driving behavior to assess risk.

If you have a clean driving record with no accidents or traffic violations, you’re likely to enjoy lower premium rates. Conversely, a history of accidents or DUI charges can significantly increase your premium as insurers view you as a higher risk.

Driving History

Your driving history is a critical component in determining your premium because it serves as a reflection of your risk as a driver. Insurance companies analyze various aspects of your driving record, including:

- Accidents: Having a history of multiple accidents can lead to higher premiums, as insurers perceive you as more likely to file future claims.

- Traffic Violations: Speeding tickets and other violations can negatively affect your premium, showcasing a pattern of risky driving behavior.

- Claims History: Frequent claims, even if they are minor, can increase your perceived risk and subsequently, your costs.

Vehicle Type

The type of vehicle you drive also plays a significant role in determining your insurance costs. Different cars have varying insurance prices based on several considerations:

- Make and Model: High-performance or luxury vehicles typically cost more to insure due to their repair costs and theft rates.

- Safety Ratings: Cars equipped with advanced safety features may qualify for discounts, as they are statistically less likely to be involved in severe accidents.

- Age of the Vehicle: Newer cars usually have higher premiums because of their value, while older models may be less expensive to insure.

Location

Your geographical location can greatly affect your car insurance premiums. Insurers evaluate various location-specific factors, which include:

- Crime Rates: Areas with higher theft and vandalism rates can lead to increased premiums, as insurers face greater risks of loss.

- Traffic Density: Urban areas with heavy traffic often see higher accident rates, prompting increased insurance costs.

- Weather Conditions: Regions prone to severe weather events, such as hail or flooding, can also cause higher premiums due to the increased likelihood of damage.

The interplay of these factors ultimately determines your car insurance premium. By understanding how your driving history, vehicle type, and location collectively influence your insurance costs, you can take proactive steps to secure more affordable coverage.

Common Mistakes When Comparing Quotes

Source: canva.com

When it comes to comparing car insurance quotes, many individuals fall into certain traps that can lead to poor decisions and unnecessary expenses. Understanding these common mistakes can help you navigate the process more effectively, ensuring that you secure the best possible coverage at a competitive rate. A frequent oversight during the comparison process is failing to read the policy details thoroughly.

Insurance policies can be complex, and relying solely on quoted prices can lead to misunderstandings regarding coverage scope and exclusions. Another mistake is overlooking available discounts, which may significantly lower your premium if not considered.

Frequent Pitfalls in Comparison

Many people encounter specific pitfalls while comparing car insurance quotes that can adversely affect their choices. Being aware of these mistakes is crucial for making informed decisions. Here are some common errors:

- Focusing Solely on Price: While cost is important, the cheapest option may not provide adequate coverage. Always evaluate what each policy includes.

- Ignoring Policy Exclusions: Some policies might seem appealing based on the price alone, but hidden exclusions can leave you unprotected in critical situations. Always read the fine print.

- Neglecting Customer Reviews: Ignoring customer feedback can lead to selecting a provider with poor service or claims handling. Take time to research reviews for insights into customer satisfaction.

- Not Comparing Similar Coverage Levels: Ensure that you are comparing quotes for the same levels of coverage and deductible amounts. This creates a fair comparison.

- Overlooking Discounts: Many insurers offer discounts for various reasons, such as bundling policies or being a good driver. Failing to inquire about these can lead to higher premiums than necessary.

“Reading the fine print is just as important as shopping around for the best price.”

The importance of reading policy details cannot be overstated. Without a clear understanding of what your insurance covers, you might find yourself in a difficult situation during a claim. Take the time to examine key elements such as liability limits, collision, and comprehensive coverage.Additionally, overlooking discounts is a common error that can inflate your insurance costs. For instance, many insurers provide reductions for safe driving records, being claims-free, or even for students with good grades.

Make sure to ask your insurer about all possible discounts you might qualify for.By being aware of these common errors and taking proactive steps to avoid them, you can ensure a more effective comparison of car insurance quotes, ultimately leading to better coverage and savings.

Tips for Getting the Best Car Insurance Rates

Finding affordable car insurance rates doesn’t have to be a daunting task. With the right strategies, you can enhance your eligibility for lower rates and discover various discounts that insurers offer. This section will guide you through effective ways to secure the best rates while ensuring you have adequate coverage.

Strategies for Improving Personal Eligibility for Lower Rates

Improving your personal eligibility for lower car insurance rates involves several proactive measures. Insurers typically assess various factors, and making adjustments can lead to significant savings.

- Maintain a Clean Driving Record: Safe driving is one of the most effective ways to reduce your premiums. Avoiding accidents and traffic violations demonstrates to insurers that you are a responsible driver.

- Improve Your Credit Score: Most insurers use credit scores as a factor in determining rates. A higher credit score can lead to lower premiums, so managing your credit responsibly can be beneficial.

- Choose a Higher Deductible: Opting for a higher deductible can lower your monthly premium. However, ensure that you can afford the deductible in the event of an accident.

- Limit Your Mileage: If you drive less, consider enrolling in a usage-based insurance program. Many insurers offer lower rates for low-mileage drivers, recognizing them as lower risk.

Benefits of Bundling Insurance Policies

Bundling your car insurance with other insurance policies can lead to significant savings. Insurers often provide discounts for customers who hold multiple policies, such as home or renters insurance.

- Cost Savings: Bundling can result in a lower overall premium compared to purchasing each policy separately.

- Convenience: Managing multiple policies with one insurer simplifies billing and renewals, streamlining your insurance experience.

- Enhanced Coverage: Some insurers offer additional perks or coverage options when you bundle, providing extra value for your policies.

Potential Discounts Offered by Insurers, Compare Car Insurance Quotes

Insurance companies provide a variety of discounts that can help you lower your car insurance premium. It’s essential to inquire about these when getting a quote.

Maximizing the available discounts can significantly reduce your overall insurance costs.

- Safe Driver Discount: For drivers with a clean driving record, many insurers offer discounts as a reward for safe driving habits.

- Multi-Policy Discount: As mentioned earlier, bundling insurance policies often provides savings.

- Good Student Discount: Young drivers enrolled in school with good grades may qualify for discounts based on academic performance.

- Military or Professional Discounts: Certain professions or military service can lead to exclusive discounts, so check with your insurer.

- Low Mileage Discount: If you drive less than a certain number of miles per year, you may qualify for this discount.

- Defensive Driving Course Discount: Completing a certified defensive driving course can also lower your premium.

Reviewing Car Insurance Quotes

Source: madebyteachers.com

When it comes to obtaining car insurance, simply gathering quotes isn’t enough; it’s crucial to thoroughly review and evaluate each option. This process not only helps you find the most cost-effective policy but also ensures that you are adequately covered in the event of an accident or other insurance claim. Understanding the specifics of coverage and comparing key features can save you from potential headaches down the road.Evaluating the comprehensiveness of coverage is essential in ensuring that you select a policy that meets your needs.

Key factors to consider when reviewing quotes include the types of coverage offered, limits, deductibles, and any additional benefits provided.

Methods to Evaluate Coverage Offered

It’s important to assess the coverage options presented in each quote. The following points highlight the methods you can use to evaluate the comprehensiveness of each car insurance policy:

- Types of Coverage: Ensure the quote includes essential coverage types such as liability, collision, comprehensive, medical payments, and uninsured/underinsured motorist coverage.

- Limits and Deductibles: Check the policy limits for each coverage type and understand the deductibles you would need to pay in the event of a claim. Higher limits usually mean better protection but may come with increased premiums.

- Additional Benefits: Look for perks that can enhance your coverage such as roadside assistance, rental car reimbursement, or diminished value coverage after a claim.

- Exclusions: Review the exclusions in each policy. Understanding what is not covered can be as crucial as knowing what is included.

To better visualize the key differences among your quotes, creating a comparison table can be beneficial. This table will allow for a side-by-side analysis of the various features and costs associated with each policy.

Comparison Table for Key Differences

When organizing a comparison table, it’s essential to include relevant details that matter to you. Here’s an example structure for your table:

| Insurance Provider | Coverage Types | Limits | Deductibles | Monthly Premium | Additional Benefits |

|---|---|---|---|---|---|

| Provider A | Liability, Collision, Comprehensive | $100,000/$300,000 | $500 | $120 | Roadside Assistance, Rental Reimbursement |

| Provider B | Liability, Collision | $50,000/$100,000 | $1,000 | $95 | None |

| Provider C | Liability, Collision, Comprehensive, Medical Payments | $250,000/$500,000 | $750 | $110 | Free Car Replacement, New Car Replacement |

This format clearly delineates the differences among the insurance providers and helps you make informed decisions based on your requirements.

Assessing Customer Service Ratings Based on Reviews

Customer service is a critical aspect to consider when reviewing car insurance quotes. A policy with the best pricing may not be worthwhile if the provider has poor customer service ratings. To effectively assess customer service ratings, consider the following:

- Online Reviews: Check review platforms and forums where customers share their experiences with claims processing, customer support responsiveness, and overall satisfaction.

- Ratings from Independent Agencies: Look for ratings from agencies like J.D. Power, A.M. Best, or Consumer Reports, which provide reliable insights into customer satisfaction and financial stability.

- Social Media Feedback: Monitor social media platforms for real-time feedback from policyholders. Companies often respond to inquiries and complaints in these spaces, giving insight into their customer service approach.

- Word of Mouth: Ask friends or family about their experiences with different insurance providers. Personal recommendations can often guide you toward companies with strong customer service records.

By thoroughly evaluating coverage options, using comparison tables, and considering customer service ratings, you will be better equipped to select the car insurance policy that best fits your needs and budget.

Finalizing Your Car Insurance Choice

Choosing the right car insurance policy is a crucial step in protecting yourself on the road. After comparing various quotes, it’s time to finalize your decision by examining the policy’s features and terms. Understanding what to look for in your final choice can significantly impact your coverage and financial wellness in the future.

Policy Flexibility and Renewal Terms

When finalizing your car insurance choice, it’s essential to consider how flexible the policy is and what the terms are for renewal. Insurance needs can change over time due to various factors such as changes in your driving habits, vehicle upgrades, or even lifestyle changes. A policy that offers flexibility allows you to adjust your coverage as needed without significant penalties.Renewal terms are equally important.

Some insurers may automatically renew your policy, while others may require you to take action. It’s wise to clarify whether any changes in premiums or coverage will occur upon renewal. Always read the fine print and understand what happens when your policy nears its expiration.

Confirming Coverage Before Making a Decision

Before you finalize your car insurance choice, confirming your coverage details is a critical step. This involves ensuring that the policy meets all your requirements and provides adequate protection. It’s not just about the price; the quality of coverage is equally important. You should confirm the following aspects:

- Coverage Limits: Make sure that the limits of liability, collision, and comprehensive coverage align with your needs.

- Deductibles: Understand how much you will need to pay out of pocket before your insurance kicks in.

- Exclusions: Familiarize yourself with what is not covered under the policy to avoid surprises later.

- Additional Benefits: Look for any extras such as roadside assistance, rental car reimbursement, or accident forgiveness.

“Understanding the full scope of your coverage is key to making an informed decision.”

Essential Questions to Ask an Insurance Agent

Engaging with insurance agents can provide valuable insights and help clarify any uncertainties. Before finalizing your policy, consider asking the following essential questions to ensure you’re making the best choice for your circumstances:

- What discounts are available that I might qualify for?

- How do claims processing and customer service work?

- Are there any penalties for early cancellation of the policy?

- What is the process for adjusting my coverage if my needs change?

- How does your claims process compare to other companies?

These questions not only help you understand the nuances of the policy but also gauge the insurer’s responsiveness and willingness to assist you in the future. Having clear answers will provide peace of mind as you finalize your car insurance choice.

Concluding Remarks: Compare Car Insurance Quotes

In conclusion, comparing car insurance quotes is not just a smart financial move but a necessary one to ensure you have the right coverage at the best price. By following the Artikeld steps and keeping in mind the common pitfalls, you can navigate the comparison process with confidence. Remember, taking the time to review your options can lead to substantial savings and better coverage, ultimately benefiting you in the long run.

Clarifying Questions

Why is it important to compare car insurance quotes?

Comparing car insurance quotes helps you find the best coverage at the lowest possible price, ensuring you’re not overpaying for your policy.

How often should I compare car insurance quotes?

It’s a good practice to compare quotes at least once a year or whenever you experience a significant life change, such as moving or purchasing a new vehicle.

Can I negotiate my car insurance premium?

Yes, you can often negotiate your premium, especially if you have found lower quotes from other providers or have improved your driving record.

What factors should I consider when comparing car insurance quotes?

Consider coverage limits, deductibles, discounts, customer service ratings, and the insurer’s financial stability.

Are online comparison tools reliable?

Yes, online comparison tools are generally reliable, but it’s important to cross-check with insurance companies directly for the most accurate information.