Online Car Insurance Quotes Made Simple and Accessible

Online Car Insurance Quotes sets the stage for a modern approach to securing the best car insurance that fits your needs. In today’s tech-savvy world, obtaining car insurance quotes online has become both efficient and user-friendly, allowing consumers to compare options easily. By leveraging technology, individuals can now navigate the insurance landscape with just a few clicks, making informed decisions that can lead to significant savings.

This process not only saves time but also empowers users with a wealth of information, enabling them to understand the nuances of different policies and premiums. As we delve deeper into this topic, we’ll explore the benefits, processes, and critical factors that come into play when searching for the ideal online car insurance quote.

Overview of Online Car Insurance Quotes

In today’s digital age, obtaining car insurance quotes online has become a pivotal aspect of the insurance process. This modern approach allows consumers to quickly and conveniently compare rates and coverage options from various providers, empowering them to make informed decisions tailored to their unique needs. The significance of online car insurance quotes lies not only in their accessibility but also in their ability to streamline what was once a tedious and time-consuming task.The advantages of obtaining quotes online over traditional methods are numerous.

First, the online process eliminates the need for lengthy phone calls or in-person visits to insurance offices. Consumers can receive multiple quotes at once, saving valuable time and effort. Moreover, online platforms often provide users with easy-to-understand comparisons, highlighting differences in coverage, deductibles, and premium costs. This level of transparency enables consumers to assess their options more effectively and select the best fit for their budget and requirements.

Advantages of Online Quotes

The benefits of online car insurance quotes extend beyond mere convenience. The following points illustrate the key advantages of opting for online quotes:

- Time Efficiency: Users can gather quotes in a matter of minutes from multiple insurers, significantly reducing the time spent on research and comparison.

- Convenience: Online platforms are accessible 24/7, allowing consumers to obtain quotes at their leisure without needing to adhere to business hours.

- Comprehensive Comparisons: Online tools provide side-by-side comparisons of different policies, making it easier to identify the best coverage options and premiums.

- Customization: Many online tools allow users to customize their coverage options and see how changes affect their premiums in real time.

- Technology Integration: Advanced algorithms and data analytics enhance the accuracy of quotes and streamline the application process, thus improving the overall customer experience.

The role of technology in transforming the car insurance quote process cannot be overstated. With the increasing use of artificial intelligence and machine learning, insurance companies can now analyze vast amounts of data to provide more accurate and personalized quotes. This not only leads to better pricing but also enhances risk assessments, allowing insurers to tailor their offerings to individual consumers.

“The future of car insurance is not just in quotes; it’s in personalized experiences driven by data.”

In summary, the integration of technology in the online car insurance quote process marks a significant advancement in how consumers interact with insurance providers. By harnessing the power of the internet and digital tools, individuals gain a greater understanding of their options, ultimately leading to more informed choices in their insurance journeys.

Process of Obtaining Online Car Insurance Quotes

Source: storyblok.com

Obtaining car insurance quotes online is a streamlined process that empowers drivers to make informed decisions. The digital age has made it easier than ever to compare rates and coverage options from the comfort of your home. Here’s a comprehensive breakdown of how to navigate this process effectively.The process of acquiring quotes is straightforward and can be completed in just a few steps.

Many insurers and comparison websites have simplified their interface to enhance user experience, making it accessible to everyone, regardless of technical skill. To ensure you receive accurate and competitive quotes, it is crucial to prepare the necessary information beforehand.

Step-by-Step Procedure for Getting Quotes Online, Online Car Insurance Quotes

The following steps will guide you through the process of obtaining online car insurance quotes:

1. Research and Choose Insurers

Start by identifying insurance providers or comparison websites. A diverse selection can yield better quotes.

2. Gather Required Information

Before you begin filling out forms, collect the necessary details. This typically includes:

Personal information (name, address, date of birth)

Vehicle details (make, model, year, VIN)

Driving history (previous claims, violations)

Desired coverage options (liability limits, comprehensive, collision, etc.)

3. Visit Insurance Websites or Comparison Platforms

Navigate to the website of the insurer or a comparison tool. Many platforms allow you to input information just once to receive multiple quotes.

4. Fill Out the Quote Form

Enter the collected information into the online quote form. Accuracy is key to ensure you receive fair and accurate estimates.

5. Review Quotes and Coverage Options

After submitting your information, you will receive quotes. Take the time to compare not only the prices but also the coverage details and deductibles.

6. Consult with Agents if Necessary

If you have specific queries, don’t hesitate to contact customer service or a representative for clarity.

7. Finalize Your Choice

Once you’ve found a quote that meets your needs, proceed with the application process, which often involves further verification of your details.

Information Needed to Generate Accurate Quotes

To generate accurate car insurance quotes, provide the following essential information:

Personal Details

Name, age, gender, marital status, and occupation.

Vehicle Information

Make, model, year, and current mileage of the vehicle.

Driving History

Years of driving experience, any past accidents or claims, and prior insurance coverage.

Coverage Preferences

Desired levels of liability, comprehensive, and collision coverage.

Safety Features

Information on anti-theft devices, safety ratings, or any driver education courses completed.Having this information on hand ensures a smooth quoting process and more precise estimates.

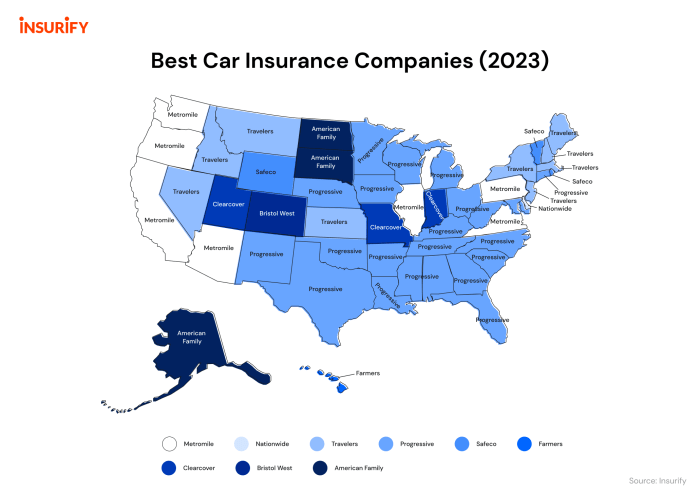

Commonly Used Online Platforms for Comparing Car Insurance Quotes

Numerous online platforms can assist in comparing car insurance quotes. These tools not only streamline the process but also help in uncovering the best deals. Here is a list of some of the most reliable options:

- Geico: Known for competitive rates and user-friendly online quotes.

- Progressive: Offers a tool to compare multiple insurance providers and find the best rates.

- State Farm: Provides personalized quotes and a vast network of agents.

- Esurance: A digital-first company that offers quick quotes online.

- Compare.com: A dedicated comparison site that allows users to input their information and receive multiple quotes at once.

- Insurify: An innovative platform that uses artificial intelligence to compare rates and coverage efficiently.

Using these platforms not only saves time but also ensures that you have access to a variety of options to suit your insurance needs.

Factors Affecting Car Insurance Quotes

When obtaining car insurance quotes, several key factors significantly influence the premiums an individual will pay. Understanding these factors can help consumers make informed decisions, ensuring they choose a policy that fits their needs while also being economical. Here, we examine the major elements that contribute to car insurance pricing, including demographics, driving history, and claims records.

Demographic Influences on Insurance Quotes

Various demographic factors play a crucial role in determining car insurance premiums. Insurers assess risk levels based on age, location, and the type of vehicle driven. Each of these factors can lead to variations in quotes, reflecting the statistical likelihood of claims.

- Age: Younger drivers, particularly those under 25, tend to incur higher premiums due to inexperience and statistically higher accident rates. For instance, a 22-year-old may pay up to 30% more than a 40-year-old with a clean driving record.

- Location: Urban areas often have higher insurance costs compared to rural settings. The density of traffic, crime rates, and the likelihood of accidents can lead to increased premiums. For example, residents of Los Angeles typically face higher quotes than those living in less populated areas.

- Vehicle Type: The make and model of a vehicle affect the cost of insurance. High-performance cars or those with advanced technology features usually attract higher premiums due to their repair costs and potential for theft.

Driving History and Claims Records

An individual’s driving history and previous claims record are paramount in influencing insurance quotes. Insurers view these records as indicators of future risk.

- Driving History: A clean driving record with no accidents or moving violations results in lower premiums. Conversely, a history of speeding tickets or accidents can lead to higher quotes, as insurers consider these drivers more likely to file claims.

- Claims Record: Frequent claims significantly affect premiums. If a driver has filed multiple claims in a short period, insurers may classify them as high-risk, resulting in increased rates. For example, a driver with two accidents in three years might see their rates increase by 20% or more.

“Insurers often use a points system to evaluate driving records, where more points correspond to higher risk and thus, higher premiums.”

Tips for Finding the Best Online Car Insurance Quotes

Finding the best online car insurance quotes can be a daunting task, but with a few strategies in place, you can simplify the process and maximize your savings. It’s essential to not only compare quotes across different insurers but also to understand how various factors can impact your premiums. Below are some tips that can guide you in navigating the world of online car insurance efficiently.

Strategies for Comparing Quotes

When comparing quotes from different insurers, it’s important to consider several factors to ensure you are getting the best deal. Start by gathering at least three to five quotes from various providers. This allows you to see the range of prices and coverages available.

- Use reputable comparison websites to gather multiple quotes quickly.

- Ensure that the quotes you receive are for the same levels of coverage and deductible amounts for an accurate comparison.

- Look for online tools provided by insurers that allow you to customize your quote based on your specific needs.

- Review the financial strength and customer service ratings of each insurer to ensure reliability and support in case of claims.

Maximizing Discounts for Savings

Many insurers offer a range of discounts that can significantly reduce your premium. Understanding and taking advantage of these discounts can lead to substantial savings.

- Bundle your car insurance with other policies, such as home or renters insurance, to receive a multi-policy discount.

- Maintain a clean driving record; many insurers provide discounts for safe driving habits over time.

- Take a defensive driving course, which is often recognized by insurers as a way to reduce your premium.

- Inquire about discounts for low mileage, as some insurers offer lower rates for those who drive less frequently.

Importance of Reading Reviews and Understanding Policy Terms

Before making a purchase, it’s crucial to read reviews and understand the policy terms to avoid any unpleasant surprises later. Customer reviews can provide insights into the claims process and overall customer satisfaction.

- Utilize online resources such as consumer review sites to gauge the reputation of each insurance provider.

- Pay close attention to the exclusions and limitations in the policy to ensure you are adequately covered.

- Request clarification from agents about any terms or conditions that seem unclear, ensuring you fully understand your coverage.

- Consider the provider’s claims handling process, as a smooth claims experience can make all the difference during stressful times.

Common Mistakes to Avoid When Getting Quotes

When it comes to obtaining online car insurance quotes, many individuals make common mistakes that can lead to higher premiums or inadequate coverage. Recognizing these pitfalls can save both time and money, ensuring that you secure the best possible deal for your needs. This section highlights some of the frequent errors people encounter and offers guidance on how to navigate the process more effectively.

Providing Inaccurate Information

One of the most significant mistakes individuals make is providing inaccurate or incomplete information when filling out quote forms. Insurers rely on the details you provide to assess risk and determine premiums. If you misreport your driving history, vehicle details, or personal information, the quoted price may not reflect your true risk profile.

The accuracy of your information directly impacts your insurance premium and coverage adequacy.

To avoid this mistake, ensure that all data entered is correct and up-to-date. For instance, if you recently moved, include your new address, as it can affect your insurance rates significantly. Always double-check your submission before hitting the submit button.

Overlooking Additional Coverage Options

Many individuals focus solely on the basic coverage requirements when obtaining quotes and overlook additional options that could provide better protection. While state minimums are essential, additional coverage can safeguard your finances in the event of an accident or theft.To understand the importance of comprehensive coverage, consider the following options:

- Collision Coverage: Covers damage to your car resulting from a collision, which can be crucial for newer or high-value vehicles.

- Comprehensive Coverage: Offers protection against non-collision incidents, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re involved in an accident with a driver who lacks adequate insurance.

- Personal Injury Protection (PIP): Covers medical expenses for you and your passengers, regardless of fault.

Evaluating and considering these options can help prevent potential financial pitfalls in the future. Always assess your individual needs and lifestyle when selecting your coverage.

Failing to Compare Multiple Quotes

Another common error is not comparing multiple quotes from different insurers. Each insurance company uses different algorithms to calculate premiums, which can lead to significant variations in pricing.

Failure to shop around can result in missing out on better rates and coverage.

Take the time to gather quotes from various providers, as this can uncover more competitive options. Online platforms make this process easier, allowing you to receive multiple quotes quickly.

Ignoring Discounts

Many individuals miss out on potential discounts that could significantly lower their insurance costs. Insurers often provide various discounts based on factors like safe driving records, bundling policies, or even membership in certain organizations.To maximize your savings, be sure to ask about the available discounts when obtaining quotes. For instance, if you have completed a defensive driving course, many insurers will offer a discount for demonstrating your commitment to safe driving practices.

Understanding the Fine Print in Insurance Quotes

Source: publicdomainpictures.net

When browsing through online car insurance quotes, it’s essential to take a closer look at the fine print. The fine print usually contains critical details that can significantly impact your coverage and premiums. Understanding the terminology and specifics in this section can help you make informed decisions and avoid unpleasant surprises later on.Insurance policies and quotes often come filled with jargon that may seem confusing at first glance.

Terms such as “deductible,” “premium,” “liability coverage,” and “exclusions” are common, and knowing what they mean is crucial for any policyholder. A deductible is the amount you pay out of pocket before your insurance kicks in, while a premium is the regular payment you make for your coverage. Liability coverage protects you against claims resulting from injuries and damage to others if you’re at fault in an accident.

Understanding these terms empowers you to navigate your policy confidently.

Common Terms and Jargon in Insurance Quotes

Familiarizing yourself with the terminology used in insurance can demystify the process. Here is a brief overview of some key terms often found in insurance quotes:

- Premium: The amount you pay for your insurance coverage, typically on a monthly or annual basis.

- Deductible: The amount you are required to pay out of pocket before your insurance covers the remaining costs in the event of a claim.

- Liability Coverage: A section of your policy that covers damages and injuries you may cause to others while driving.

- Collision Coverage: Coverage that pays for damages to your car after an accident regardless of who is at fault.

- Comprehensive Coverage: Protects against non-collision-related incidents, such as theft, vandalism, or natural disasters.

- Exclusions: Specific situations or conditions that are not covered by your insurance policy.

Understanding coverage limits and exclusions is vital when assessing an insurance quote. Coverage limits refer to the maximum amount your insurer will pay for a claim under certain circumstances. Below these limits, you are responsible for any excess costs. Exclusions can significantly affect your financial liability in unfortunate incidents—common exclusions include driving under the influence, racing, and using your vehicle for commercial purposes.

Knowing these limitations ensures you aren’t caught off guard when filing a claim.

Policy Types and Coverage Overview

To clarify what different policy types cover, it’s helpful to look at a detailed comparison. The following table Artikels various car insurance policy types and their coverage:

| Policy Type | Coverage Description |

|---|---|

| Liability Insurance | Covers damages to other vehicles and medical expenses for others in accidents where you are at fault. |

| Collision Insurance | Covers damage to your own vehicle resulting from a collision with another vehicle or object. |

| Comprehensive Insurance | Offers coverage for damage to your vehicle from non-collision events, such as theft, vandalism, or natural disasters. |

| Uninsured/Underinsured Motorist Coverage | Protects you if you are in an accident with a driver who does not have insurance or does not have enough insurance to cover your damages. |

| Personal Injury Protection (PIP) | Covers your medical expenses and, in some cases, lost wages after an accident, regardless of who is at fault. |

In summary, understanding the fine print in your insurance quotes, including common terms, coverage limits, and exclusions, can greatly enhance your ability to choose the right insurance policy for your needs. Recognizing the distinctions between different policy types helps ensure that you are adequately covered in various driving scenarios.

The Future of Online Car Insurance Quotes

Source: publicdomainpictures.net

The online car insurance quoting landscape is evolving rapidly, driven by technological advancements and changing consumer preferences. As more people turn to digital solutions for convenience and efficiency, the insurance industry is adapting to meet these demands. This transformation not only enhances the user experience but also introduces new ways to improve accuracy and personalization in insurance offerings.

Emerging Trends in Online Insurance Quoting

The online car insurance industry is witnessing several emerging trends that signify a shift towards more efficient and consumer-friendly practices. These trends include enhanced digital tools, real-time data usage, and increased competition among insurers. The adoption of technologies like artificial intelligence (AI) and machine learning is redefining how quotes are generated and how risk is assessed.

- Increased Use of AI: AI is automating many aspects of the quoting process, from data collection to risk evaluation. Insurers can analyze vast amounts of data quickly, allowing for more accurate and personalized quotes.

- Real-Time Pricing: Insurers are leveraging telematics and other data sources to provide real-time pricing. This means quotes can adjust dynamically based on driving behavior and other factors, offering consumers a more tailored experience.

- Consumer-Centric Platforms: New platforms are emerging that focus on user experience, making it easier for consumers to compare quotes and find the best rates without confusion or complexity.

- Integration of Blockchain: The potential use of blockchain technology in insurance could enhance transparency and security in the quoting process, building consumer trust and streamlining transactions.

Innovations in Underwriting Processes

Innovations such as AI and machine learning are transforming underwriting processes within the online car insurance sector. These technologies enable insurers to assess risk factors with unprecedented precision and speed. By analyzing various data points, including historical claims data, driving records, and even social media activity, insurers can refine their underwriting criteria.

“AI-driven underwriting processes reduce the time taken to issue quotes, leading to improved customer satisfaction.”

As a result, consumers can receive quotes that are not just quick, but also reflective of their unique circumstances. This shift is creating a more personalized insurance experience that can adapt to individual needs.

Shifting Consumer Behavior Toward Digital Solutions

Consumer behavior in the car insurance market is increasingly leaning towards digital solutions. More customers prefer the convenience of obtaining quotes online rather than through traditional methods, which often involve lengthy paperwork and time-consuming phone calls.The preference for digital solutions is influenced by several factors:

- Convenience: Consumers appreciate the ability to obtain quotes from the comfort of their homes, at any time of the day, without the need for in-person consultations.

- Access to Information: Online platforms provide easy access to reviews, comparison tools, and educational resources, empowering consumers to make informed decisions.

- Speed: The quick turnaround time for receiving quotes online meets the demand for immediate results, essential in a fast-paced digital world.

- Cost-Effectiveness: Many consumers believe that digital solutions will lead to lower premiums as insurers incur reduced operational costs, which can be passed on to customers.

As the online car insurance landscape continues to develop, understanding these trends and innovations will be essential for consumers looking to make the most informed choices regarding their insurance needs.

Final Summary

In summary, Online Car Insurance Quotes have revolutionized how consumers approach purchasing auto insurance, fostering a landscape where information is readily available and comparative analysis is at your fingertips. Understanding the intricacies of quotes and avoiding common pitfalls can lead to better coverage and lower costs. As we look to the future, the integration of technology will continue to enhance the quoting process, making it even more accessible for everyone.

Essential FAQs

What is an online car insurance quote?

An online car insurance quote is an estimate of the cost of insurance coverage, generated using information provided through online platforms.

How do I get accurate online car insurance quotes?

To get accurate quotes, provide detailed information about your vehicle, driving history, and coverage preferences when using quote comparison tools.

Are online quotes as reliable as those from agents?

Yes, online quotes can be just as reliable as those from agents, as they are based on the same underwriting criteria used by insurance companies.

Can I adjust my coverage after receiving a quote?

Absolutely! You can adjust your coverage options before finalizing your policy to better meet your needs and budget.

Are there any fees for obtaining online quotes?

No, obtaining online quotes is typically free of charge, allowing you to compare prices without any obligation.