Insurance Comparison Websites Simplifying Your Choices

Insurance Comparison Websites are transforming the way consumers approach their insurance needs, making it easier than ever to navigate through the often complex and overwhelming insurance landscape. These platforms allow users to easily compare different insurance products, ensuring they find the best coverage for their individual circumstances. By providing a side-by-side view of policy options, prices, and key features, these websites empower consumers with the knowledge necessary to make informed decisions about their insurance.

From health and auto insurance to home and travel coverage, these sites cater to a variety of insurance types, offering users an efficient tool to streamline their decision-making process. By leveraging technology and user-friendly features, insurance comparison websites enhance the shopping experience, allowing consumers to save time and money while ensuring they secure the right policy to meet their needs.

Overview of Insurance Comparison Websites

Insurance comparison websites are digital platforms that allow users to compare various insurance products and prices from multiple providers in one place. The primary aim of these websites is to simplify the process of finding the most suitable insurance coverage by providing users with a side-by-side comparison of different policies, premiums, and coverage options. This user-friendly approach enhances the ability to make informed decisions about insurance purchases.On these websites, users can typically compare several types of insurance, including but not limited to health insurance, auto insurance, home insurance, life insurance, and travel insurance.

By entering basic information, users receive tailored quotes that help them gauge their options effectively. This accessibility facilitates a more thorough understanding of the market, assisting consumers in identifying the best deals available.

Advantages of Using Insurance Comparison Websites

Utilizing insurance comparison websites offers several notable benefits over traditional methods of obtaining insurance quotes, which often involve time-consuming phone calls or in-person visits to multiple agents. Here are the key advantages of these platforms:

- Time Efficiency: Users can quickly view multiple options without needing to contact each insurer individually. This streamlined process saves considerable time in the decision-making process.

- Cost Savings: By comparing prices from different insurers, users can identify better deals and potentially save money on their premiums. Many sites also offer exclusive discounts available only through their platform.

- Informed Choices: Comparison sites provide comprehensive information, including customer reviews and policy details, which helps users understand the nuances of different insurance products and make well-informed decisions.

- Convenience: Users can access these websites anytime and anywhere, making it easy to compare insurance options without the constraints of traditional office hours.

- Transparency: These platforms foster a sense of transparency in the insurance market by allowing users to see a range of options and services available, minimizing the influence of agents and sales tactics.

Insurance comparison websites empower consumers with knowledge, enabling them to secure the best possible insurance coverage at competitive rates.

Features of Insurance Comparison Websites

Insurance comparison websites serve as valuable tools for consumers seeking to navigate the complex landscape of insurance products. With the right features, these platforms can simplify the decision-making process, allowing users to find the best coverage options that suit their needs and budgets. Recognizing essential features can significantly enhance the user experience and ensure that individuals make informed decisions.

Key Features to Look For

When exploring insurance comparison websites, users should prioritize certain features that facilitate an efficient and effective search. Here are some of the pivotal features that enhance user experience:

- Comprehensive Coverage Options: A well-rounded comparison website should display a broad spectrum of insurance types such as auto, health, life, and home insurance. For instance, platforms like Policygenius allow users to compare multiple types of insurance under one roof, making it easier to evaluate different policies simultaneously.

- Customizable Filters: Users benefit from being able to filter results based on their specific criteria, such as price, coverage limits, and deductible amounts. Sites like Compare.com offer users the ability to adjust these filters, ensuring the results align with their preferences and financial situations.

- User Reviews and Ratings: Incorporating user reviews provides potential buyers with insights into the experiences of previous policyholders. A website that includes customer feedback helps users gauge the reliability and satisfaction associated with different insurers, enhancing their trust in the process.

- Quotes Comparison: The ability to instantly compare quotes from multiple providers is crucial. Websites like Insure.com present side-by-side quotes, allowing users to identify the best deals quickly. This feature minimizes time spent searching and maximizes value for the user.

- User-Friendly Design: A clean, intuitive interface is essential for a seamless experience. Navigation should be straightforward, allowing users to find what they need without unnecessary clicks. Websites such as NerdWallet exemplify this by organizing information clearly and ensuring that users can easily access various services.

Importance of User-Friendly Design and Navigation

The design and navigation of an insurance comparison website are crucial to its effectiveness. A user-friendly interface not only enhances the overall experience but also encourages users to explore their options more thoroughly. A simple layout with clear menus and logical pathways reduces frustration, allowing users to focus on comparing insurance products rather than deciphering how to navigate the site.

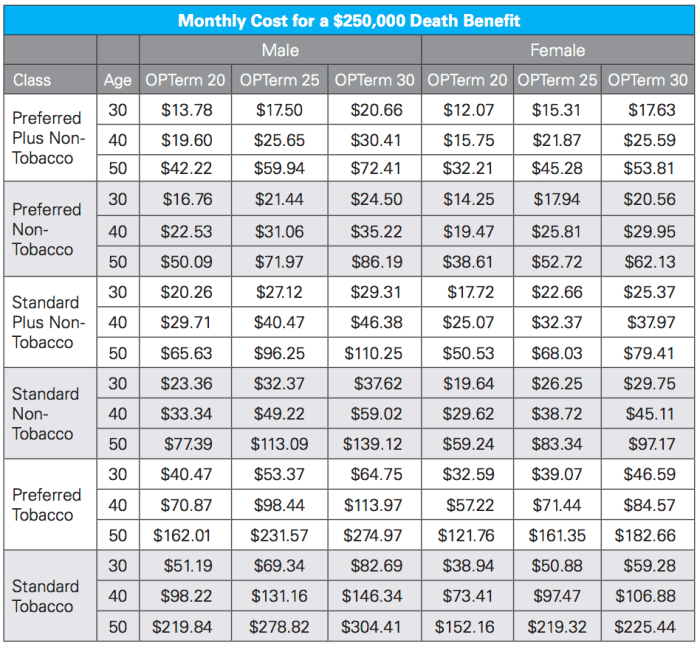

The use of visual aids like icons or charts can also help convey information quickly and clearly. For example, a comparison chart that visually separates different policy types and premiums can streamline the process of selecting an insurance plan.Additionally, responsive design ensures that users can access the site efficiently across various devices, including smartphones and tablets. With the increasing trend of mobile browsing, having a website that adapts seamlessly to different screen sizes is paramount.

A site that is easy to navigate encourages users to return, fostering brand loyalty and trust.

“A user-friendly design is not just about aesthetics; it’s about creating an experience that enables informed decisions.”

Benefits of Using Insurance Comparison Websites

Source: picpedia.org

Using insurance comparison websites has become a game-changer for consumers looking to navigate the often complex world of insurance. These platforms not only simplify the process but also bring numerous advantages to the table. By harnessing technology and data, they provide a wealth of information that empowers consumers to make informed decisions regarding their insurance needs.

Financial Benefits for Consumers

One of the most significant advantages of using insurance comparison websites is the potential for substantial financial savings. By allowing users to compare multiple insurance quotes side by side, these platforms enable consumers to find the best deals tailored to their specific needs.

-

Consumers can save an average of 20-30% on their premiums simply by comparing prices from different providers.

This means that a person looking for car insurance could potentially save hundreds of dollars annually.

- Many comparison websites also offer exclusive discounts or promotions that are not available directly through insurers. This added incentive can lead to even greater savings.

- The transparency in pricing helps consumers avoid hidden fees or unnecessary add-ons that might inflate costs when dealing with individual insurers.

Time-Saving Advantages

In today’s fast-paced world, time is a luxury that most of us cannot afford to waste. Insurance comparison websites streamline the selection process, making it quicker and more efficient for users to find suitable coverage.

- With just a few clicks, consumers can access multiple quotes, eliminating the need to visit various websites or make numerous phone calls.

- The platforms typically feature user-friendly interfaces and simple navigation, allowing customers to filter options based on their preferences, such as coverage type, price range, and customer ratings.

- This efficiency not only saves time but also reduces the stress associated with shopping for insurance, making it a more pleasant experience overall.

Transparency Offered by Comparison Websites

Insurance comparison websites promote transparency, which is crucial for informed decision-making. They provide comprehensive information about policies, terms, and conditions in a clear and concise manner.

- Consumers can easily access key details about coverage limits, deductibles, and exclusions, ensuring that they fully understand what they’re signing up for.

- This level of transparency helps build trust between consumers and insurers, as individuals can make choices based on factual information rather than vague promises.

- Additionally, many comparison websites include customer reviews and ratings, giving potential buyers insights into the experiences of others with different insurers.

Limitations and Challenges

Source: thebluediamondgallery.com

While insurance comparison websites offer a streamlined approach to finding suitable policies, there are notable drawbacks to relying solely on these platforms. Users may overlook important factors when making decisions based solely on online comparisons. It’s essential to understand the limitations involved, particularly regarding the depth of coverage options and the accuracy of information displayed.One of the main challenges is that not all insurance providers participate in comparison websites.

This can lead to a restricted view of available policies, as some insurers may choose not to list their offerings, potentially leaving users unaware of better options. Furthermore, the policies shown may not provide comprehensive coverage details. A user might be drawn to a low premium but fail to notice significant exclusions or limitations within the coverage.

Coverage Options Displayed

The selection of coverage options presented on comparison websites often varies significantly. Users should be aware of the following limitations:

- Limited Insurer Participation: Many reputable insurers may not be represented on these platforms, leading to a narrower selection of options.

- Policy Exclusions: Comparison sites may not thoroughly detail exclusions, leaving users with gaps in understanding what is not covered.

- Variability in Policy Features: Some policies may have unique features that are not easily comparable, making it hard to assess true value.

- Outdated Information: The data on comparison websites might not be updated in real-time, potentially leading to discrepancies with current offerings or premiums.

Always verify that the information you receive aligns with the direct offerings from insurers to ensure you’re making an informed choice.

The importance of verifying information provided by comparison websites cannot be understated. Users should cross-reference the details found on these platforms with direct communications from insurers. This diligence helps confirm that quotes are accurate and policies meet specific needs. Checking user reviews and ratings can also provide insights into the reliability of both the comparison site and the insurance products listed.

Ultimately, while comparison websites can serve as a useful starting point, thorough research is crucial to ensure comprehensive protection.

Best Practices for Using Insurance Comparison Websites

Source: staticflickr.com

When it comes to finding the right insurance, comparison websites can be a valuable resource. They allow users to evaluate numerous options in one place, making it easier to select a policy that fits their needs and budget. However, to maximize the benefits of these platforms, users should follow some best practices that can streamline the process and enhance the outcomes.Using an insurance comparison website effectively requires diligence and awareness.

To help you navigate this process, here’s a checklist of essential steps to follow while using these platforms. These steps not only facilitate a more efficient search but also help ensure that you make well-informed decisions based on comprehensive data.

Checklist for Using Insurance Comparison Websites

Before diving into quotes, it’s important to prepare and gather the necessary information. Here’s a handy checklist to follow:

- Define your coverage needs: Identify the types of insurance you require, such as auto, home, or health insurance.

- Gather personal information: Have your details ready, including your age, location, driving history (for auto insurance), and any relevant health information.

- Set a budget: Determine how much you are willing to spend on premiums before starting your comparison.

- Choose reputable comparison websites: Look for platforms that are well-known and provide comprehensive comparisons from various insurers.

- Review policy details: Understand the coverage limits, exclusions, and deductibles associated with each quote.

- Consider provider reputation: Research the insurers included in the comparisons and check their customer service ratings and claims handling reputation.

- Take notes: Keep track of different quotes, policy features, and your impressions of each option.

- Ask questions: Don’t hesitate to reach out to insurers for clarifications about any policies you are considering.

By adhering to this checklist, users can avoid potential pitfalls and ensure that they are well-equipped to make informed comparisons.

Reputable Insurance Comparison Websites

Selecting the right comparison website is crucial for effective insurance shopping. Here are some reputable platforms consumers can consider:

- Policygenius: This site offers a wide range of insurance types, including life, health, and home insurance, and features a user-friendly interface.

- Insurify: Known for its quick quote comparisons, Insurify allows users to input their information once to receive multiple quotes from different insurers.

- Compare.com: This platform specializes in auto insurance comparisons, providing users with detailed quotes and policy comparisons from various providers.

- SmartFinancial: This comparison site helps users find the best rates on car insurance while considering their unique circumstances.

- EverQuote: Focused on auto insurance, EverQuote connects users with a range of quotes tailored to their specific needs.

Using these reputable websites can significantly enhance the user experience and improve the chances of finding the best insurance deals.

Methods for Effectively Comparing Quotes

To truly benefit from insurance comparison websites, implementing effective comparison methods is key. Here are strategies that can help users make the most out of their comparison experience:

- Use the same coverage criteria: When comparing quotes, ensure that the coverage levels and deductibles are consistent across all options to make valid comparisons.

- Analyze total costs: Look beyond the premium amounts; consider total costs, including deductibles, co-pays, and any additional fees associated with the policy.

- Evaluate customer reviews: Research reviews and ratings for each insurance company to assess their customer service and claims satisfaction levels.

- Check for discounts: Many insurers offer discounts for bundling policies or for safe driving. Factor these into your comparisons.

- Consult insurance agents: Sometimes a quick chat with an insurance agent can provide insights that a comparison website may not offer.

By applying these methods, users can ensure that they are not only looking for the best price but also considering the overall value and quality of the insurance they choose.

Future Trends in Insurance Comparison Websites

As the digital landscape evolves, insurance comparison websites are poised for significant transformations. Emerging trends and advancements in technology are set to reshape how consumers interact with these platforms. The increasing demand for convenience and personalized services indicates a shift that will likely impact both the functionality of these websites and consumer behavior.

Emerging Trends and Technologies

The insurance industry is witnessing a surge in innovative trends driven by technology. Key advancements such as big data analytics, blockchain, and enhanced user interfaces are redefining the user experience on comparison websites.

- Big Data Analytics: Insurance comparison websites will leverage big data to provide tailored recommendations, ensuring users receive options that closely align with their unique needs and preferences.

- Blockchain Technology: By utilizing blockchain, these platforms can enhance transparency and security, facilitating trust between consumers and providers while streamlining the policy comparison process.

- Mobile Optimization: As more consumers turn to mobile devices for their insurance needs, comparison websites will increasingly focus on mobile-friendly designs, allowing for seamless browsing and purchasing experiences.

- Integration of IoT Devices: With the rise of the Internet of Things (IoT), insurance comparison sites will integrate data from smart devices to offer real-time quotes and personalized insurance products based on lifestyle monitoring.

Changes in Consumer Behavior

The way consumers search for and purchase insurance is evolving, driven by factors such as increased digital literacy and the desire for seamless online experiences.

- Informed Decision-Making: Today’s consumers are more informed than ever, often conducting extensive research before making a purchase. This trend requires comparison websites to present data clearly and concisely to facilitate quick decision-making.

- Preference for Personalization: Users increasingly expect personalized experiences. Comparison websites will need to employ AI-driven algorithms to tailor recommendations based on individual profiles and prior interactions.

- Shift to Instant Gratification: With the expectation of immediate results, insurance comparison platforms must optimize their response times and streamline the quote process to cater to this demand.

Impact of Artificial Intelligence

Artificial intelligence (AI) is set to revolutionize insurance comparison websites by enhancing the accuracy and efficiency of the comparison process.

- Enhanced Algorithms: AI can improve predictive analytics, enabling more accurate risk assessments and enabling consumers to find policies that best fit their profiles.

- Chatbots and Virtual Assistants: These AI-powered tools will assist users in real-time, answering queries and guiding them through the comparison process, thus improving customer satisfaction.

- Fraud Detection: AI can help combat fraudulent claims by detecting patterns and anomalies in user behavior, thus protecting both consumers and insurance providers.

The integration of AI into insurance comparison websites not only enhances user experience but also fosters innovation within the insurance sector.

Wrap-Up

In conclusion, Insurance Comparison Websites stand as invaluable resources in today’s digital age, simplifying the insurance purchasing journey while promoting transparency and informed choices. As these platforms continue to evolve with emerging trends and technologies, their potential to reshape the insurance market grows. Embracing the conveniences they offer can lead to significant savings and a more tailored insurance experience, ultimately benefiting consumers in a way that traditional methods simply cannot.

Common Queries

How do insurance comparison websites work?

They collect data from various insurance providers, allowing users to compare policies and prices based on their preferences and needs.

Are the quotes provided on these websites accurate?

While most quotes are accurate, it’s essential to verify details with the insurance provider before making a purchase.

Is it safe to use insurance comparison websites?

Yes, reputable sites use encryption and secure protocols to protect user data while offering a safe comparison experience.

Do I have to pay to use these comparison websites?

No, most insurance comparison websites are free to use for consumers.

Can I buy insurance directly through comparison websites?

Some insurance comparison websites allow direct policy purchases, while others may redirect you to the insurer’s website to complete the transaction.