Flood and Natural Disaster Coverage An Essential Guide

Flood and Natural Disaster Coverage sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Understanding the intricacies of insurance coverage for floods and natural disasters is crucial for homeowners and businesses alike, as it not only safeguards property but also provides peace of mind in the face of unpredictable events.

This guide will delve into the importance of this coverage, explore the types available, and Artikel the claims process, all while debunking common myths and discussing future trends.

Understanding Flood and Natural Disaster Coverage

Flood and natural disaster coverage is a critical component of comprehensive insurance policies, especially for residents in areas prone to such calamities. This coverage provides financial protection against losses incurred from various natural disasters, ensuring that policyholders can recover and rebuild their lives after a disaster strikes.The importance of flood and natural disaster coverage cannot be overstated. Without adequate insurance, individuals and businesses may face devastating financial burdens following a natural disaster.

Many standard homeowners’ policies do not include flood coverage, which can lead to significant out-of-pocket expenses for repairs and reconstruction. Understanding what types of disasters are covered and the specifics of flood insurance is essential for ensuring adequate protection.

Types of Natural Disasters Typically Covered by Insurance

Natural disaster insurance policies often encompass a variety of events that can cause significant damage. The most common types of natural disasters covered typically include:

- Floods: Water damage from heavy rainfall or melting snow.

- Hurricanes: Wind and water damage caused by severe storms.

- Earthquakes: Structural damage from seismic activity.

- Tornadoes: Destruction from high winds and debris.

- Wildfires: Damage from uncontrolled fires affecting homes and properties.

Understanding these types of disasters is crucial for homeowners and businesses to assess their risk and determine the necessary coverage.

Inclusions and Exclusions of Flood Coverage in Standard Policies

Flood coverage can vary significantly between policies, often containing specific inclusions and exclusions. It is vital for policyholders to be aware of these details to avoid unexpected surprises during claims.The inclusions typically found in flood insurance policies include:

- Damage to the structure of the home, including walls, floors, and foundation.

- Personal property loss, including furniture and appliances.

- Debris removal costs associated with flood-related damage.

Conversely, common exclusions in flood coverage may involve:

- Damage caused by surface water or water seepage through foundations or walls.

- Losses occurring due to lack of maintenance or wear and tear.

- Property outside the designated flood zone may not be covered under some policies.

It’s crucial for homeowners to review their insurance policies carefully to ensure they have the right coverage in place and understand the limitations associated with flood risks.

“Understanding your flood and disaster coverage can mean the difference between recovery and financial strain in the aftermath of unforeseen events.”

Types of Flood Coverage

Source: opentextbc.ca

Flood insurance plays a critical role in safeguarding properties against the devastating impact of flood events. Understanding the various types of flood coverage available helps property owners make informed decisions that could save them from significant financial losses. By exploring the options, including the National Flood Insurance Program (NFIP) and private flood insurance, one can better navigate the complexities of flood risk management.

National Flood Insurance Program (NFIP)

The NFIP is a federally backed program that provides flood insurance to property owners, renters, and businesses in participating communities. This program is essential for people living in high-risk flood zones, as it offers coverage that might not be available through traditional insurance policies. The NFIP coverage includes two main components: building coverage and contents coverage.

- Building Coverage: This covers the structure itself, including foundation, electrical and plumbing systems, and appliances. The maximum coverage amount for residential properties is typically $250,000.

- Contents Coverage: This covers personal belongings within the home, like furniture and electronics, with a maximum limit of $100,000.

Private Flood Insurance

Private flood insurance has emerged as an alternative to the NFIP, providing more flexibility in terms of coverage amounts and policy features. This type of insurance is typically offered by private companies and can include higher coverage limits, as well as additional options such as replacement cost over actual cash value.

- Customization: Policyholders often have more choices for customizing their coverage, including options for additional living expenses during repairs.

- Waiting Periods: While NFIP policies generally have a 30-day waiting period before coverage takes effect, some private insurers may offer immediate coverage.

Residential vs. Commercial Flood Coverage

The distinctions between residential and commercial flood insurance are significant and cater to the specific needs of property types. Residential flood coverage is designed for homeowners and renters, whereas commercial flood insurance protects business properties and their contents.

- Residential Coverage: This typically includes policies that cover single-family homes, condominiums, and apartments. The focus is on protecting personal property and living spaces.

- Commercial Coverage: This covers buildings used for business operations, such as offices, warehouses, and retail spaces, along with their contents. Business interruption insurance can also be included to cover lost income during flood events.

Regional Requirements for Flood Insurance

Flood insurance requirements can vary significantly depending on the region and its flood risk. Areas identified by the Federal Emergency Management Agency (FEMA) as high-risk flood zones often have stricter requirements for obtaining flood insurance.

- Mandatory Purchase Requirements: Homeowners with mortgages from federally regulated or insured lenders must purchase flood insurance if their property is located in a special flood hazard area (SFHA).

- Community Participation: Communities must participate in the NFIP to provide coverage, impacting availability and cost of insurance in various regions.

- Local Regulations: Some states or municipalities may have additional regulations or incentives to encourage flood insurance purchases, making it essential for property owners to understand local laws.

“Understanding your flood insurance options can be the difference between recovery and devastation in the aftermath of a flood.”

The Claims Process for Flood Damage

Filing a flood insurance claim may seem overwhelming, but understanding the process can simplify it significantly. This step-by-step guide provides clear insights into what to expect, ensuring that you can navigate through the claims process efficiently and effectively.

Step-by-step Process of Filing a Flood Insurance Claim

When faced with flood damage, timely action is crucial. Here’s a breakdown of the systematic approach to filing a flood insurance claim:

1. Notify Your Insurance Company

As soon as you can, contact your flood insurance provider to report the damage. This initiates the claims process.

2. Document the Damage

Take detailed photographs and videos of the affected areas and the damages. Ensure that you capture images from various angles to provide a complete view of the destruction.

3. Complete a Proof of Loss

Within 60 days of the flood event, you must submit a Proof of Loss form, which Artikels the extent of the damages and the amount you claim. This document is critical for your claim.

4. Provide Supporting Documentation

Gather all necessary documentation, including repairs estimates, receipts for repairs, and any relevant records that support your claim.

5. Schedule an Adjuster Visit

Your insurance company will likely send an adjuster to assess the damages. Be prepared to show them any previously documented evidence.

6. Receive the Claim Decision

After reviewing your claim, the insurance company will provide a decision. They will communicate whether your claim is approved and the amount covered.

7. Review and Appeal if Necessary

If your claim is denied or you believe the settlement is insufficient, you have the right to appeal the decision. Ensure you understand your policy and the reasoning provided for any denials.

Common Documentation Required to Support a Flood Damage Claim

Having the right documentation is essential to ensure a smooth claims process. The following items are commonly required when filing a flood damage claim:

Proof of Loss Form

A detailed account of the damage and the claimed amount.

Photos and Videos

Visual evidence of the damage before and after repairs.

Repair Estimates

Written estimates from licensed contractors detailing the cost of repairs.

Receipts

Proof of expenses incurred due to the flooding, such as temporary housing or emergency repairs.

Policy Documents

A copy of your flood insurance policy to verify coverage details. Providing complete and accurate documentation can significantly expedite your claim and support the validity of your request.

Best Practices for Documenting and Reporting Damages

Accurate documentation and timely reporting are vital components of a successful flood insurance claim. Here are some best practices to enhance your claim submission:

Act Quickly

Start documenting the damage immediately after the floodwaters recede. Delays can lead to missed evidence or diminished credibility.

Be Thorough

Compile a comprehensive record of all damage, including both structural and personal property damage. This includes items like furniture, electronics, and valuable possessions.

Keep Copies

Maintain copies of all correspondence with your insurance company, including claim forms and any communication via email or phone.

Follow Up Regularly

Stay in touch with your insurance adjuster and company. Regular follow-ups ensure that your claim remains on track and that you are informed of any changes.

Utilize Technology

Consider using apps or software designed for insurance claims to store and organize your documentation effectively.By adhering to these practices, you can significantly improve the chances of a smooth claims process and the fulfillment of your flood insurance coverage.

Factors Influencing Flood Insurance Premiums

Flood insurance premiums can vary significantly based on several key factors. Understanding these factors is crucial for property owners, as they directly impact the cost of coverage. As the risk of flooding increases due to climate change and urban development, being informed about what influences premiums can help homeowners make better financial decisions regarding their insurance needs.One of the primary factors affecting flood insurance premiums is the location of the property.

Areas designated in high-risk flood zones typically see higher premiums due to the increased likelihood of flooding. In the United States, properties located in Special Flood Hazard Areas (SFHAs) are more susceptible to flooding, and as a result, insurance costs are elevated for these zones. Conversely, properties in low-risk areas often enjoy lower premiums.

Impact of Location and Flood Zone Designations

The designation of a flood zone significantly impacts insurance costs. The Federal Emergency Management Agency (FEMA) categorizes flood zones, which helps determine the flood risk and, subsequently, the insurance premium. Understanding these zones can clarify the potential costs associated with flood insurance. Here are the major flood zone classifications and their implications on premiums:

- Zone A: Areas with a 1% annual chance of flooding, typically face higher premiums due to the high risk. The lack of base flood elevation data can further increase costs.

- Zone AE: Similar to Zone A but with established base flood elevation levels. Insurance premiums are still high, but there might be some reductions available for mitigation efforts.

- Zone X: Low-risk areas with less than a 0.2% annual chance of flooding generally enjoy significantly lower premiums, making them more attractive for property investments.

- Zone V: Coastal areas subject to storm surges face elevated premiums due to the additional risk associated with hurricanes and tropical storms.

The risk associated with a property is not solely determined by its flood zone designation; various mitigation measures can also influence the premium. By implementing certain strategies, homeowners can effectively reduce their risk profile and, consequently, their insurance costs.

Mitigation Measures to Lower Insurance Premiums

Mitigation measures refer to the steps taken to reduce the risk of flood damage. Implementing these measures not only protects the property but can also lead to lower insurance premiums. Here are some effective strategies:

- Elevation of the Property: Raising the building above the base flood elevation can significantly decrease the risk of flooding, often resulting in reduced premiums.

- Installation of Flood Vents: These allow floodwaters to flow through the foundation, minimizing damage and potentially lowering insurance costs.

- Use of Flood-Resistant Materials: Constructing or renovating homes with flood-resistant materials can enhance resilience and may lead to premium discounts.

- Creating Barriers: Installing levees or flood walls can help protect property from floodwater, which insurers may recognize in premium calculations.

By understanding these influential factors, property owners can better navigate their flood insurance options and take proactive steps to manage costs effectively.

The Role of Government in Flood Insurance

The government plays a crucial role in the landscape of flood insurance, primarily through the National Flood Insurance Program (NFIP). This federal program is designed to provide flood insurance to property owners, renters, and businesses, ensuring that people are not left in financial ruin after a flood event. Understanding the NFIP and its implications is essential for homeowners and businesses in flood-prone areas.The NFIP allows property owners to obtain flood insurance at premiums that reflect the risk of flooding in their areas.

This program is vital as it provides coverage that is often unavailable through private insurers, particularly in high-risk zones. Additionally, the NFIP encourages communities to implement floodplain management and mitigation practices that can help reduce the risk of future flooding, ultimately benefiting public safety and property values across the board.

The National Flood Insurance Program (NFIP)

The NFIP was established in 1968 to address the increasing costs of flood disasters and to provide a safety net for those living in flood-prone regions. It provides coverage for damages caused by flooding, which is often excluded from standard homeowners’ insurance policies. Here are key aspects of the NFIP:

- Risk Mapping: Communities are mapped to assess flood risk, creating flood zones that determine insurance requirements and rates.

- Insurance Availability: The NFIP makes flood insurance accessible to property owners, including those in high-risk areas who might struggle to find coverage otherwise.

- Community Participation: Communities must adopt and enforce floodplain management regulations to participate in the NFIP, ensuring better preparation and response to flooding.

- Federal Backing: The program is backed by the U.S. government, providing security to policyholders that their claims will be honored even after large-scale flooding events.

Government Regulations and Flood Insurance Rates

Government regulations significantly influence flood insurance rates and availability. The NFIP utilizes a rating system that considers various factors, including the property’s elevation, distance to water bodies, and historical flood data. These regulations can lead to fluctuations in insurance premiums based on the perceived risk. For instance, properties in designated high-risk flood zones typically face higher premiums, whereas those in lower-risk areas may benefit from lower rates.In recent years, the NFIP has also introduced new rating methodologies, such as Risk Rating 2.0, which aims to modernize the assessment of flood risk by incorporating more localized data.

This shift can alter insurance costs, often resulting in increased premiums for some property owners previously enjoying lower rates.

Climate Change and Government Flood Insurance Policies

Climate change poses significant challenges for government flood insurance policies, as rising sea levels and increasing storm intensity lead to more frequent and severe flooding. Consequently, the NFIP faces mounting pressure to adapt its policies to reflect these realities. The impact of climate change raises several critical considerations:

- Adjusting Coverage: The NFIP must continually reassess flood risk maps and coverage options to accurately represent changing environmental conditions.

- Increased Premiums: As flood risks escalate due to climate change, policyholders may experience rising premiums, even for properties that previously had stable rates.

- Funding Challenges: The NFIP’s financial sustainability is threatened by increasing claims payouts, necessitating reforms in how the program is funded and managed.

- Mitigation Investments: Government policies may increasingly focus on funding mitigation efforts to reduce flood risks, including infrastructure improvements and environmental restoration projects.

Common Myths About Flood Insurance: Flood And Natural Disaster Coverage

Source: tasnimnews.com

Many homeowners believe they have a solid understanding of flood insurance, yet misconceptions about coverage can leave them vulnerable when disaster strikes. Myths surrounding flood insurance can lead to a lack of preparedness and an incorrect understanding of policy benefits. By debunking these prevalent myths, we can highlight the importance of being informed about flood risks and the specifics of insurance coverage.One common myth is that standard homeowners insurance policies cover flood damage.

In reality, most standard policies exclude flood damage, necessitating separate flood insurance to safeguard against this peril. This misconception can leave homeowners in dire situations, especially in flood-prone areas. According to the National Flood Insurance Program (NFIP), over 20% of flood insurance claims come from properties outside high-risk flood zones, illustrating how widespread this issue is.

Myth: Flood Insurance is Only for High-Risk Areas, Flood and Natural Disaster Coverage

A prevalent misconception is that flood insurance is unnecessary for homes located outside designated flood zones. This belief can be misleading since floods can occur in unexpected areas due to various factors like heavy rainfall, snowmelt, or even dam failures. The NFIP states that approximately 40% of flood claims are filed by policyholders living in low- to moderate-risk zones. The following data helps illustrate the significance of flood insurance coverage regardless of location:

- Statistically, floods are the most common and widespread natural disaster in the U.S.

- Insurance claims related to flooding can take years to settle, leaving homeowners financially vulnerable without adequate coverage.

- FEMA reports that homes in low-risk zones are still subject to about 25% of all flood insurance claims, emphasizing the unpredictability of flood events.

Myth: Federal Disaster Assistance Covers All Flood Damage

Many individuals wrongly assume that federal disaster assistance will cover their losses fully in the event of a flood. While federal aid can provide some help, it often falls short of covering all damages, especially when compared to comprehensive flood insurance. For instance, FEMA assistance is typically a loan that must be repaid and may not cover living expenses or personal property losses.Important points regarding federal disaster assistance include:

- Disaster assistance often comes with stringent eligibility requirements, leaving many uninsured losses unaddressed.

- FEMA assistance typically averages only a fraction of the total costs incurred from flood damage.

- Individuals receiving assistance may still need flood insurance to fully recover and rebuild after the disaster.

Myth: Flood Insurance is Too Expensive

Another common myth is that flood insurance is prohibitively expensive. While costs can vary based on location and property characteristics, flood insurance premiums can be surprisingly affordable, especially compared to the potential financial burden of flood damage. Factors impacting the cost of flood insurance include:

- The property’s elevation relative to flood zones, with lower elevations generally incurring higher premiums.

- Mitigation measures such as flood-proofing or elevating structures, which can lead to reduced premiums.

- Local building codes and community participation in the NFIP may also affect premium pricing.

Understanding these myths and the realities of flood insurance coverage is crucial for protecting homes and financial well-being in the event of flooding.

Preparing for Natural Disasters

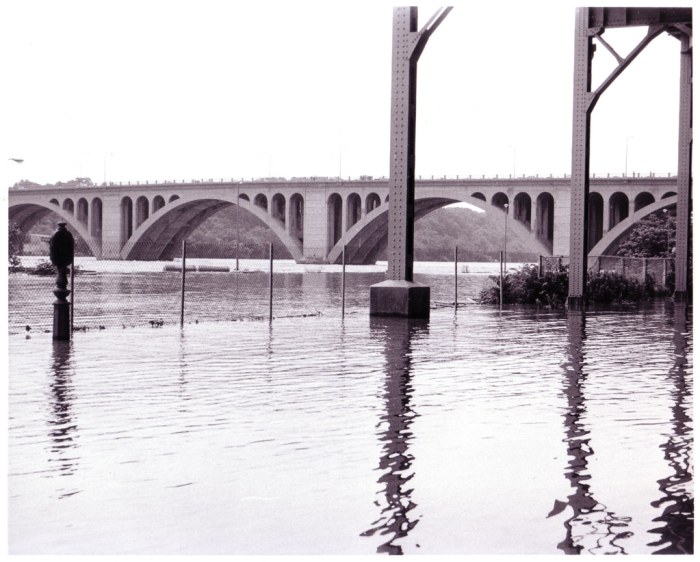

Source: staticflickr.com

Natural disasters can strike at any time, and being prepared is essential for minimizing the impact on your home and family. Flooding, in particular, poses a significant threat to many communities, making it crucial for homeowners to take proactive steps to safeguard their lives and property. This section provides a comprehensive checklist for flood preparedness, details emergency plans, and organizes community support resources to ensure you’re ready when disaster strikes.

Checklist for Homeowners to Prepare for Potential Flooding

Creating a solid preparedness plan starts with having a thorough checklist. This ensures that you are ready to face a flood or natural disaster without unnecessary stress. Below is a checklist that homeowners can use to prepare for flooding:

- Inspect your property for potential flood risks, such as low-lying areas.

- Clear gutters and storm drains of debris to ensure proper drainage.

- Install sump pumps in your basement, if applicable, to prevent water accumulation.

- Raise electrical components and utilities above potential flood levels.

- Store important documents in a waterproof container and keep copies off-site.

- Prepare an emergency kit that includes food, water, medications, and first aid supplies.

- Create a communication plan with family and friends to stay connected during evacuations.

Emergency Plans Incorporating Flood Preparedness Strategies

An effective emergency plan can make a significant difference during a flood. Incorporating flood-specific strategies into your emergency plan ensures that you and your family are ready to act quickly and safely. Here are key components to consider:

- Designate a safe meeting place outside of your home where family members can regroup if evacuation becomes necessary.

- Establish a list of emergency contacts, including local authorities, healthcare providers, and family members.

- Familiarize yourself with local evacuation routes and shelters that accept pets if necessary.

- Regularly review and practice the emergency plan with all family members, ensuring everyone knows their roles and responsibilities.

Resources for Community Support During Natural Disasters

Community support is critical during natural disasters. Having access to local resources can aid in recovery efforts and provide assistance to those in need. Below are some key resources to consider:

- Local emergency management agencies often provide resources for disaster preparedness, response, and recovery.

- Nonprofit organizations, such as the Red Cross, offer shelter, food, and medical assistance during emergencies.

- Community forums and social media groups can be invaluable for sharing information and resources during a disaster.

- Local churches and community centers often organize volunteer efforts and donations to aid affected families.

“Preparedness is the key to resilience; being ready can make all the difference when disaster strikes.”

Future Trends in Flood and Disaster Coverage

As climate change and urban development continue to heighten the risks associated with flooding and other natural disasters, the landscape of flood insurance is rapidly evolving. Insurers are now leveraging advanced technologies to create more nuanced and responsive policies that cater to the changing needs of consumers and the environment. This transformation is being driven by a combination of big data analytics, innovative coverage options, and a shift towards more proactive risk management.The integration of technological advancements into flood insurance policies is reshaping how risks are assessed and managed.

With the rise of big data and predictive modeling, insurance providers are able to analyze vast amounts of information related to weather patterns, geographical changes, and historical claims data. This enables them to provide more accurate flood risk assessments and tailor policies to the unique circumstances of individual properties.

Technological Advancements in Flood Risk Assessment

Emerging technologies play a crucial role in enhancing the accuracy of flood risk assessments. The following factors illustrate how these advancements are being utilized:

- Remote Sensing and GPS Technology: These tools provide detailed imagery and data on land use, vegetation, and soil saturation levels. This information is essential for identifying areas at higher risk of flooding.

- Machine Learning Algorithms: By analyzing historical claims and weather data, machine learning models can predict potential flood events with greater precision, allowing insurers to adjust their risk assessments dynamically.

- Geographic Information Systems (GIS): GIS technology helps visualize and analyze spatial data, enabling insurers to better understand flood-prone areas and tailor policies accordingly.

The implications of these technological advancements are profound. By utilizing big data, insurance companies can offer more personalized coverage options that reflect an individual’s risk profile.

Innovative Coverage Options from New Providers

New players in the insurance market are introducing innovative coverage options to meet the demands of modern consumers. These providers often focus on flexibility and customer-centric policies. Examples of innovative offerings include:

- Parametric Insurance: Instead of traditional claims processes, this type of insurance pays out a predetermined amount based on the occurrence of specific events, such as a defined level of rainfall. This approach ensures quicker payouts and minimizes administrative costs.

- On-Demand Insurance: Some insurers allow customers to purchase coverage for specific time frames or events, providing flexibility for those in temporary flood-prone areas or those who need short-term protection.

- Bundled Coverage Options: New insurers are offering bundled packages that combine flood insurance with other types of coverage, such as home or auto insurance, providing a comprehensive solution for consumers.

These innovative options not only enhance consumer choice but also encourage broader participation in flood insurance, making it more accessible to those who need it most.

“The future of flood insurance lies in its ability to adapt to changing risks through technology and consumer-oriented solutions.”

As the landscape of flood and natural disaster coverage continues to evolve, staying abreast of these trends is essential for consumers and insurers alike. The commitment to leveraging technology and innovative coverage options will be pivotal in addressing the increasing challenges posed by climate change and urbanization.

Closing Summary

In summary, having comprehensive Flood and Natural Disaster Coverage is vital for anyone looking to protect their assets against the forces of nature. By understanding the different types of coverage, the claims process, and the factors affecting premiums, policyholders can make informed decisions that enhance their preparedness. As we look toward the future, staying updated on emerging trends and government policies will be essential in navigating the evolving landscape of flood insurance.

Essential Questionnaire

What is the National Flood Insurance Program (NFIP)?

The NFIP is a federal program that provides flood insurance to property owners, renters, and businesses in participating communities.

Are floods covered by standard homeowners insurance?

No, standard homeowners insurance typically does not cover flood damage; separate flood insurance is needed.

How can I lower my flood insurance premiums?

Implementing flood mitigation measures, such as elevating your home or installing flood vents, can help reduce premiums.

Do I need flood insurance if I live outside a flood zone?

Yes, even if you are outside a designated flood zone, flooding can still occur, and having coverage can be beneficial.

How long does it take to receive payment after filing a flood claim?

The claims process can take a few days to several weeks, depending on the complexity of the claim and the documentation provided.